PT Global Digital Niaga Tbk (the “Company”; IDX: BELI), a pioneer and leading omnichannel commerce and lifestyle ecosystem in Indonesia focusing on serving digitally connected retail and institutions consumers, today announced its third quarter earnings results for the year 2025.

KEY HIGHLIGHTS

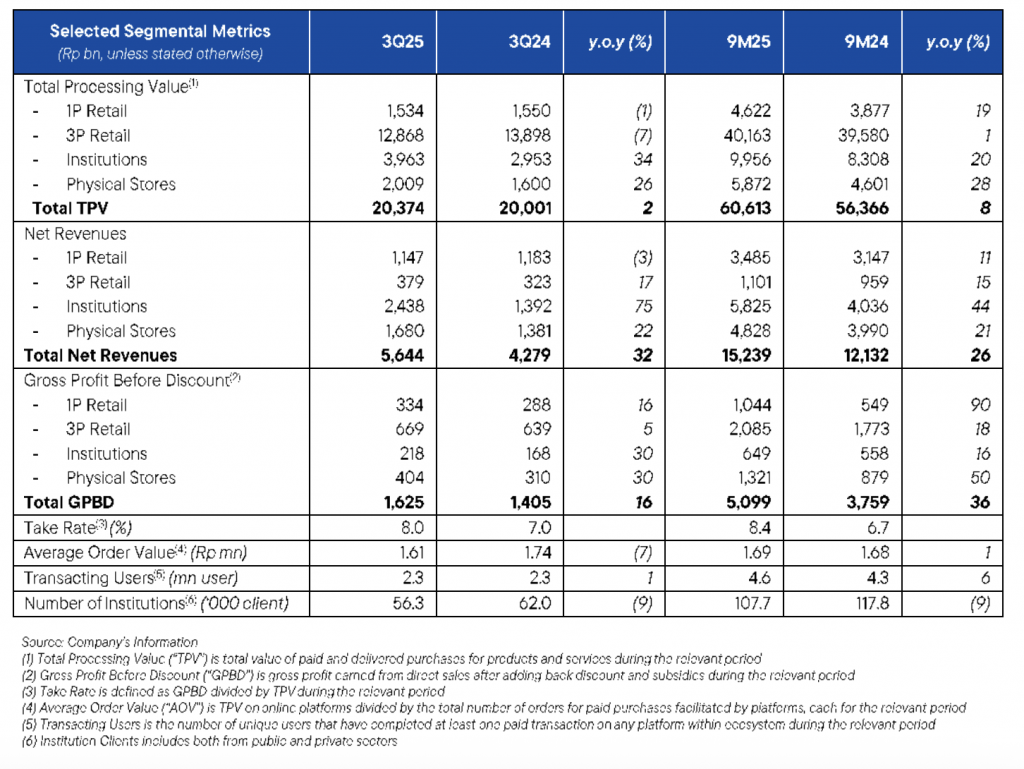

- Consolidated Net Revenues grew by 32% y.o.y in 3Q25 to Rp5,644 bn and by 26% y.o.y in 9M25 to Rp15,239 bn, mainly driven by higher contribution in the consumer electronics category, especially with higher smartphone sales volume to both retail customers and institution clients during the period.

- Take Rate expanded further from 6.7% in 9M24 to 8.4% in 9M25, on the back of Take Rate increase especially in 1P Retail and Physical Stores segments. This was a result from 36% y.o.y growth in Gross Profit Before Discount (GPBD), including 90% y.o.y growth of GPBD in 1P Retail segment and 50% y.o.y growth of GPBD in Physical Stores segment during the period.

- Better cost structure reflected by the lower consolidated Operating Expenses as percentage of TPV from 7.4% in 9M24 to 7.2% in 9M25, resulted in an improved performance of consolidated EBITDA as percentage of TPV by 40bps y.o.y.

- The Company further affirms its commitment to deliver a unified omnichannel synergy, strengthening customer loyalty, and providing a relevant and valuable shopping experience by integrating Dekoruma to its Unified Loyalty Program (Blibli Tiket Rewards) since September 2025.

- Added a total of 13 new consumer electronics stores throughout 3Q25, including the addition of new monobrand stores for hello (Apple) and Huawei as well as multibrand Blibli stores. As at the end of September 2025, the Company operated a total of 236 consumer electronics stores, as well as 58 premium supermarkets outlets and 38 home and living experience centers.

MANAGEMENT STATEMENT(S)

Kusumo Martanto – CEO & Co-Founder

As we concluded the third quarter of 2025, our performance reflects continued resilience and agility amid a dynamic consumer landscape and challenging global economic environment. Our unwavering commitment to operational excellence and strategic discipline across all business aspects has enabled us to maintain strong momentum and consistently deliver meaningful value to our customers and brand partners.

Building on the solid foundation established earlier this year, we have further strengthened our ecosystem by integrating Dekoruma into our Unified Loyalty Program, enhancing customer engagement and loyalty across our diverse brand portfolio. In line with our dedication to innovation, we have also continued to harness the power of artificial intelligence across our platforms and operations, driving increased productivity and cost efficiencies. This strategic adoption of technology positions us to remain agile and responsive in an ever-evolving market landscape.

Our sustained partnerships with leading global brand principals stand as a testament to our market leadership and operational excellence. A key milestone was our appointment for the launch of the new iPhone 17 series in Indonesia, reinforcing our status as one of the trusted strategic partners of choice for premium brand activations in Indonesia market. Concurrently, our omnichannel expansion remains on course, marked by the addition of our consumer electronics outlets, premium supermarket outlets, and home and living experience centers throughout the period.

We are also proud to announce that our Company has once again been recognized in the Fortune Indonesia 100 list for this year, underscoring our consistent performance and impactful contribution to the nation’s economy. Looking ahead, we remain focus to close the year strongly by driving margin expansion and cost leadership, supported by ongoing innovation and continuous service enhancements across all our channels and platforms, to deliver superior value to our stakeholders.

Ronald Winardi – CFO

“We delivered accelerating net revenues growth and continued loss reduction in the third quarter. In the face of softer demand and heightened competition, we are maintaining strong operational discipline and expect to close the year in a better position.”

KEY OPERATIONAL HIGHLIGHTS

BUSINESS SEGMENTS OVERVIEW

Below is an overview from each of the Company’s business segment during the third quarter of 2025 (3Q25) compared to the third quarter of 2024 (3Q24) period, and the nine months of 2025 (9M25) compared to the nine months of 2024 (9M24) period.

1P Retail

1P Retail segment undertakes the Company’s business through its B2C online commerce platform for first party (1P) products and services from various categories.

GPBD for this segment recorded a healthy 16% y.o.y growth in 3Q25 to Rp334 bn, and 90% y.o.y growth in 9M25 to Rp1,044 bn. The improved GPBD performance was largely attributable to the Company’s strategic prioritization of higher-margin product categories, including new product launches in smartphones category as well as higher contributions in the sports & wellness offerings. As a result, Take Rate for this segment was successfully recorded at 22.6% during the 9M25 period. Overall TPV and Net Revenues for this segment also grew by 19% and 11% y.o.y in 9M25 to Rp4,622 bn and Rp3,485 bn, respectively.

In order to drive its 1P Retail segment, the Company has built and developed a vast network of order fulfillment, logistics and last-mile delivery infrastructure, using hub-and-spoke model, supported by 13 warehouses with a total warehouse area of approximately 200,000 square meters, as well as 19 distribution centers (hubs), enabling the Company to offer 2-hour delivery service of more than 350,000 SKUs in more than 40 cities nationwide. The warehouse in Marunda, West Java, strengthens the Company’s logistics and supply chain capabilities, including for the Fulfillment at Speed (FAS) and Fulfillment by Blibli (FBB) services.

To support its home and living category, the Company also manages 38 home and living experience centers operated by Dekoruma, to expand consumer omnichannel touchpoints in this category.

3P Retail

3P Retail segment predominantly records the Company’s platform revenue generated from sales of products and services of various categories from third party (3P) sellers through its online commerce and online travel agent (OTA) platforms.

GPBD for this segment recorded a 5% y.o.y growth in 3Q25 to Rp669 bn, and 18% y.o.y growth in 9M25 to Rp2,085 bn. The improved GPBD performance was mainly driven by higher contributions from accommodation and experiences categories of the Company’s OTA platform, which both provides higher margin. Overall TPV and Net Revenues for this segment also grew by 1% and 15% y.o.y in 9M25, to Rp40,163 bn and Rp1,101 bn, respectively.

As at the end of September 2025, the Company’s OTA platform – tiket.com offered a variety of products and services, including flight tickets from 143 domestic and international airlines serving more than 220 countries, regions, and territories, providing more than 3.6 million accommodation options, including more than 2.2 million options of alternative accommodations, and offering more than 77,700 activities in tourist destinations and more than 4,200 events worldwide.

Institutions

Institutions segment includes the Company’s institutional business through its online platforms for 1P and 3P products and services serving corporate clients across Indonesia.

GPBD for this segment recorded a solid 30% y.o.y growth in 3Q25 to Rp218 bn, and 16% y.o.y growth in 9M25 to Rp649 bn. The improved GPBD performance was mainly contributed from higher sales volume of smartphone product category to institution clients. During the nine months of 2025, this segment also managed to improve further the quality of its clients, reflected by higher spending per institutional client by 31% to Rp92.4 mn. Overall TPV and Net Revenues for this segment also grew by 20% and 44% y.o.y in 9M25, to Rp9,956 bn and Rp5,825 bn, respectively.

As at the end of September 2025, the Company’s Institutions business segment has served more than 107,000 institutional clients, with a continuously growing of monetization rate from 49% in 9M24 to 59% in 9M25, reflecting increasing trust by corporate clients on the services provided by the Company.

Physical Stores

Physical Stores segment records the Company’s business in physical consumer electronics stores collaborating with leading global consumer electronics brand principals, as well as premium grocery supermarkets chain operated by 70.6%-owned Subsidiary, PT Supra Boga Lestari Tbk (“Ranch Market”; IDX: RANC).

GPBD for this segment recorded a strong 30% y.o.y growth in 3Q25 to Rp404 bn, and 50% y.o.y growth in 9M25 to Rp1,321 bn. The improved GPBD performance was mainly driven by the higher smartphone sales volume on the back of new products launch and the continued expansion of the Company’s consumer electronic physical stores, including the addition of new monobrand stores for hello (Apple) and Huawei as well as multibrand Blibli stores. In addition, the Company’s supermarket outlets also recorded better margin during the period. Overall TPV and Net Revenues for this segment also grew by 28% and 21% y.o.y in 9M25, to Rp5,872 bn and Rp4,828 bn, respectively.

With the addition of 13 new consumer electronics stores throughout 3Q25, the Company operated a total of 236 consumer electronics stores as at the end of September 2025, which consisted of 127 monobrand stores and 109 multibrand stores. In addition, the Company also managed 58 premium supermarket outlets operated by Ranch Market.

CONSOLIDATED FINANCIAL PERFORMANCES

MANAGEMENT DISCUSSION & ANALYSIS

Below are brief descriptions of the Company’s consolidated financial performances during the third quarter of 2025 (3Q25) compared to the third quarter of 2024 (3Q24) period, and the nine months of 2025 (9M25) compared to the nine months of 2024 (9M24).

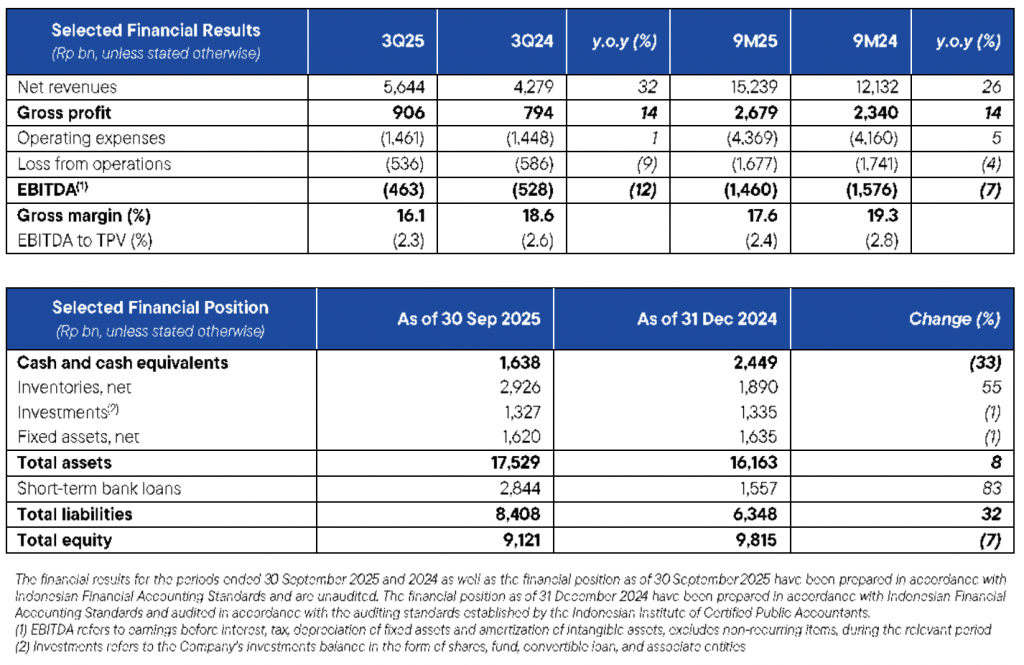

Revenue & Profitability

Consolidated Net Revenues recorded 32% y.o.y growth from Rp4,279 bn in 3Q24 to Rp5,644 bn in 3Q25, and 26% y.o.y growth from Rp12,132 bn in 9M24 to Rp15,239 bn in 9M25, driven by the improvement across all business segments, especially in the consumer electronics category, which benefited from higher smartphone sales volume, improved contribution from the Company’s institutional business, and an expanding consumer electronics physical stores network. However, due to the changes in product mix – primarily in the 1P Retail segment, resulted in a slight decline in overall consolidated Gross Margin to 17.6% in 9M25.

Throughout the period, the Company still further improved its operational excellence which resulted in better cost structure, reflected from lower consolidated Operating Expenses as percentage of TPV from 7.4% in 9M24 to 7.2% in 9M25, mainly supported by the lower consolidated other selling expenses as well as general and administrative expenses as percentage of TPV. Overall, the Company continued to improve its performance, reflected by the improved consolidated EBITDA as percentage of TPV from -2.8% in 9M24 to -2.4% in 9M25, an improvement of 40bps y.o.y.

Cash Flows

Net cash used in operating activities was recorded at Rp2,759 bn in 9M25, mainly used for cash payments to suppliers and cash payments of operating expenses partly offset by cash receipts from customers. Net cash used in investing activities was recorded at Rp178 bn in 9M25, mainly used for acquisition of fixed assets. Meanwhile, net cash provided by financing activities was recorded at Rp2,126 bn in 9M25, mainly contributed by the cash receipts of short-term bank loans, partly offset by cash payments of short-term bank loans. Therefore, the Company’s consolidated Cash and Cash Equivalents position was recorded at Rp1,638 bn as of 30 September 2025 compared to Rp2,449 bn as of 31 December 2024.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG)

The Company reaffirms its commitment to long-term value creation of sustainable practices through Blibli Tiket Action program, which embodies such commitment by promoting ESG (Environmental, Social and Governance) initiatives and encouraging active stakeholders’ participation.

Environmental Focus

The Company strengthened its environmental impact through customer and employee-driven initiatives:

- Customer Engagement

- Take-Back Packaging Program: encourages customers to return used packaging, contributing to tree-planting efforts.

- Green Delivery: reduces carbon emissions using electric vehicles.

- Trade-In Expansion: now includes lifestyle items like shoes, extending the life of products and minimizing waste.

- Misi Tanam Pohon: enables customers to donate Rp1,000 per transaction for reforestation efforts.

- Internal Participation

- Kaizen Competition: fosters a culture of continuous improvement and operational efficiency.

- One Step Further Program: promotes circular fashion through employee-led donations of gently used shoes to Desa Mendut, Magelang, Central Java.

Social Impact

The Company supported underprivileged children through educational and inspirational initiatives:

- Educational Empowerment: through the BUBBLE Program in collaboration with Rumah Belajar, the Company provided learning support for children with limited access to education in West Jakarta. Additionally, the Blizania Roleplay Activity introduced children from Yayasan Sanggar Anak Kita (SAKA) to the digital world and e-commerce through interactive play.

- Inspiration and Character Building: in partnership with Sandiaga Uno and YAMSA, the film screening of “Jumbo” aimed to inspire and build self-confidence among young viewers.

Governance Excellence

The Company continued to show its strong commitment to uphold good corporate governance practice:

- Maintained its PCI DSS 4.0 Merchant Level 1 certification, underscoring the commitment on robust data security and responsible digital governance.

- Recognized by SWA as one of Indonesia’s Most Reputable Company Champions, earning the Excellence title for its strong governance practices and trusted omnichannel platform.

BUSINESS PROSPECTS

The Company’s strategic priorities continue to translate into tangible progress with the integration of its omnichannel ecosystem which has strengthened customer engagement across both online and offline platforms, resulting in organic improvement of transacting users and customer retention. The Marunda warehouse has also begun to demonstrate its potential, optimizing inventory flow and fulfilment efficiency while providing the scalability needed to support future growth. As part of continuous drive for innovation, the Company will keep harnessing the power of artificial intelligence to understand the customers better, personalize every interaction, and deliver marketing initiatives that are more targeted and personalized. At the same time, prudent cost management and disciplined capital allocation will ensure that growth remains sustainable and value accretive.

Looking ahead, the Company is confident that the momentum achieved thus far will carry through to year-end. With a robust foundation, strengthened omnichannel infrastructure, and a clear strategic roadmap, the Company is well-positioned to capture further market opportunities and deliver lasting impact for customers, partners, and shareholders.

– End –