PT Global Digital Niaga Tbk (the “Company”; IDX: BELI), a pioneer and leading omnichannel commerce and lifestyle ecosystem in Indonesia focusing on serving digitally connected retail and institutions consumers, today announced its second quarter earnings results for the year 2025.

KEY HIGHLIGHTS

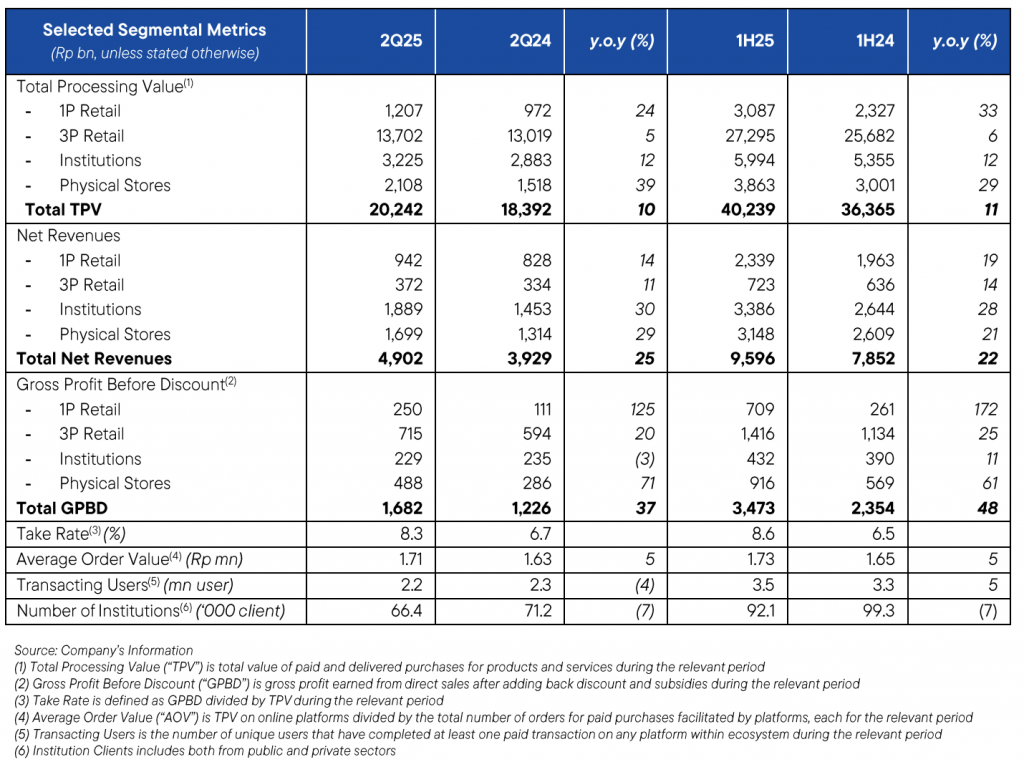

- Consolidated Net Revenues grew by 22% y.o.y in 1H25 with healthy double-digit growth trajectory across all business segments during the period.

- Take Rate expanded further from 6.5% in 1H24 to 8.6% in 1H25, on the back of Take Rate increase especially in 1P Retail and Physical Stores segments. This was a result from 48% y.o.y growth in Gross Profit Before Discount (GPBD), including 172% y.o.y growth of GPBD in 1P Retail segment during the period.

- Better cost structure reflected by the lower consolidated Operating Expenses as percentage of TPV from 7.5% in 1H24 to 7.2% in 1H25, resulted in an improved performance of consolidated EBITDA as percentage of TPV by 40bps y.o.y, from -2.9% in 1H24 to -2.5% in 1H25.

- Adjusted published rate for third-party sellers to be in line with market starting the first quarter of the year, which has further boosted the Company’s margin optimization strategy.

- Added a total of 8 new consumer electronics stores throughout 2Q25, including the addition of new monobrand stores for hello (Apple), Samsung and Huawei brands, as well as multibrand Blibli stores. As at the end of June 2025, the Company operated a total of 223 consumer electronics stores, as well as 58 premium supermarkets outlets and 36 home and living experience centers.

- Carried out Annual General Meeting of Shareholders (“AGMS”) and Extraordinary General Meeting of Shareholders (“EGMS”), where all the agendas’ items proposed were approved.

MANAGEMENT STATEMENT(S)

Kusumo Martanto – CEO & Co-Founder

“Throughout the first half of 2025, we navigated a more cautious consumer environment shaped by broader economic headwinds. While discretionary spending moderated, we remained steadfast in our commitment to operational discipline and strategic execution.

Guided by our long-term strategic plans, we proactively executed targeted initiatives to strengthen profitability and build enduring momentum. We refined our product portfolio to emphasize high-value and premium offerings, elevating customer lifetime value without sacrificing cost discipline. At the same time, our marketing investments were rebalanced towards the most efficient channels, improving precision in customer acquisition and maximizing return on spend. This approach—rooted in our omnichannel moat and powered by the Blibli Tiket ecosystem—continues to unlock synergies, enabling us to serve customers seamlessly across both digital and physical touchpoints while creating real value for sellers and brand partners.

Looking forward, we remain focused on continuous improvement and disciplined innovation. We will deepen our partnerships, refine our service experience, and leverage data-driven insights to anticipate and meet evolving consumer needs. With a clear strategic roadmap and unwavering determination, we are confident in our ability to deliver sustainable returns and reinforce our market leadership.

On behalf of the entire organization, I extend my sincere gratitude to our shareholders for their continued trust and to our outgoing commissioners for their dedicated service. We warmly welcome our newly appointed commissioner and look forward to benefitting from his guidance as we pursue our shared goal of long-term value creation.”

Ronald Winardi – CFO

“Net revenues in the second quarter continue to deliver double digits growth, amid challenging market conditions. Our GPBD also continued its positive trajectory, with the 1P Retail segment GBPD more than doubling. We are confident that this strong momentum positions us well to deliver sustained growth through the remainder of the year.”

KEY OPERATIONAL HIGHLIGHTS

BUSINESS SEGMENTS OVERVIEW

Below is an overview from each of the Company’s business segment during the second quarter of 2025 (2Q25) compared to the second quarter of 2024 (2Q24) period, and the first half of 2025 (1H25) compared to the first half of 2024 (1H24) period.

1P Retail

1P Retail segment undertakes the Company’s business through its B2C online commerce platform for first party (1P) products and services from various categories.

GPBD for this segment recorded a significant 125% y.o.y growth in 2Q25 to Rp250 bn, and by 172% y.o.y growth in 1H25 to Rp709 bn. The improved GPBD performance was largely attributable to the Company’s strategic prioritization of higher-margin product categories, including new product launches in smartphones category as well as higher contributions in home appliances and sports & wellness offerings. In addition, the contributions from Dekoruma, acquired by the Company in June 2024, further supported overall performance of this segment. Consequently, Take Rate for 1P Retail segment was successfully recorded at 23.0% during the 1H25 period. Overall TPV and Net Revenues for this segment also grew by 24% and 14% y.o.y in 2Q25, and by 33% and 19% y.o.y in 1H25, respectively.

In order to drive its 1P Retail segment, the Company has built and developed a vast network of order fulfillment, logistics and last-mile delivery infrastructure, using hub-and-spoke model, supported by 13 warehouses with a total warehouse area of more than 200,000 square meters, as well as 19 distribution centers (hubs), enabling the Company to offer 2-hour delivery service of more than 350,000 SKUs in more than 40 cities nationwide. Further, the warehouse in Marunda, West Java, which has started to operate since October 2024, strengthens the Company’s logistics and supply chain capabilities, including for the Fulfillment at Speed (FAS) and Fulfillment by Blibli (FBB) services.

To support its home and living category, the Company also manages 36 home and living experience centers operated by Dekoruma, to expand consumer omnichannel touchpoints in this category.

3P Retail

3P Retail segment predominantly records the Company’s platform revenue generated from sales of products and services of various categories from third party (3P) sellers through its online commerce and online travel agent (OTA) platforms.

GPBD for this segment recorded a healthy 20% y.o.y growth in 2Q25 to Rp715 bn, and by 25% y.o.y growth in 1H25 to Rp1,416 bn. The improved GPBD performance was mainly driven by higher contributions from all categories from the Company’s OTA business, including flights, accommodation, as well as experiences. Overall TPV and Net Revenues for this segment also grew by 5% and 11% y.o.y in 2Q25, and by 6% and 14% y.o.y in 1H25, respectively.

As at the end of June 2025, the Company’s OTA platform – tiket.com offered a variety of products and services, including flight tickets from 139 domestic and international airlines serving more than 220 countries, regions, and territories, providing more than 3.6 million accommodation options, including more than 2.2 million options of alternative accommodations, and offering more than 77,700 activities in tourist destinations and more than 4,200 events worldwide.

Institutions

Institutions segment includes the Company’s business through its B2B and B2G platforms for 1P and 3P products and services serving private and public-sector institutions across Indonesia.

GPBD for this segment also recorded a steady 11% y.o.y growth in 1H25 to Rp432 bn, despite recorded a slight decline in 2Q25 y.o.y due to tight market condition. The improved GPBD performance was mainly contributed from higher sales volume of smartphone product category to institution clients. During the first half of 2025, this segment managed to improve further the quality of its clients, reflected by higher spending per institutional client by 21% to Rp65.1 mn. Overall TPV and Net Revenues for this segment still grew by 12% and 30% y.o.y in 2Q25, and by 12% and 28% y.o.y in 1H25, respectively.

To support its Institutions segment, the Company operates Blibli SIPLah (School Procurement System) platform since 2019 and Blibli for Business platform since 2021. In addition, the Company has also been appointed as one of the main suppliers for national procurement projects through the e-catalog platform, an online shopping application developed by the Government Goods and Services Procurement Policy Agency (LKPP) since 2022.

As at the end of June 2025, the Company’s Institutions business segment has served more than 92,000 institutional clients, with a continuously growing of monetization rate from 49% in 1H24 to 56% in 1H25, reflecting increasing trust by corporate clients on the services provided by the Company.

Physical Stores

Physical Stores segment records the Company’s business in physical consumer electronics stores collaborating with leading global consumer electronics brand principals, as well as premium grocery supermarkets chain operated by 70.6%-owned Subsidiary, PT Supra Boga Lestari Tbk (“Ranch Market”; IDX: RANC).

GPBD for this segment recorded a solid 71% y.o.y growth in 2Q25 to Rp488 bn, and by 61% y.o.y growth in 1H25 to Rp916 bn. The improved GPBD performance was mainly driven by the higher smartphone sales volume on the back of new products launch and the continued expansion of the Company’s consumer electronic physical stores, including the addition of new monobrand stores for hello (Apple), Samsung and Huawei brands, as well as multibrand Blibli stores. In addition, the Company’s supermarket outlets also recorded better margin during the period. Overall TPV and Net Revenues for this segment grew by 39% and 29% y.o.y in 2Q25, and by 29% and 21% y.o.y in 1H25, respectively.

With the additional of 8 new consumer electronics stores throughout 2Q25, the Company operated a total of 223 consumer electronics stores as at the end June 2025, which consists of 122 monobrand stores and 101 multibrand stores. In addition, the Company also managed 58 premium supermarket outlets operated by Ranch Market.

CONSOLIDATED FINANCIAL PERFORMANCES

MANAGEMENT DISCUSSION & ANALYSIS

Below are brief descriptions of the Company’s consolidated financial performances during the second quarter of 2025 (2Q25) compared to the second quarter of 2024 (2Q24) period, and the first half of 2025 (1H25) compared to the first half of 2024 (1H24).

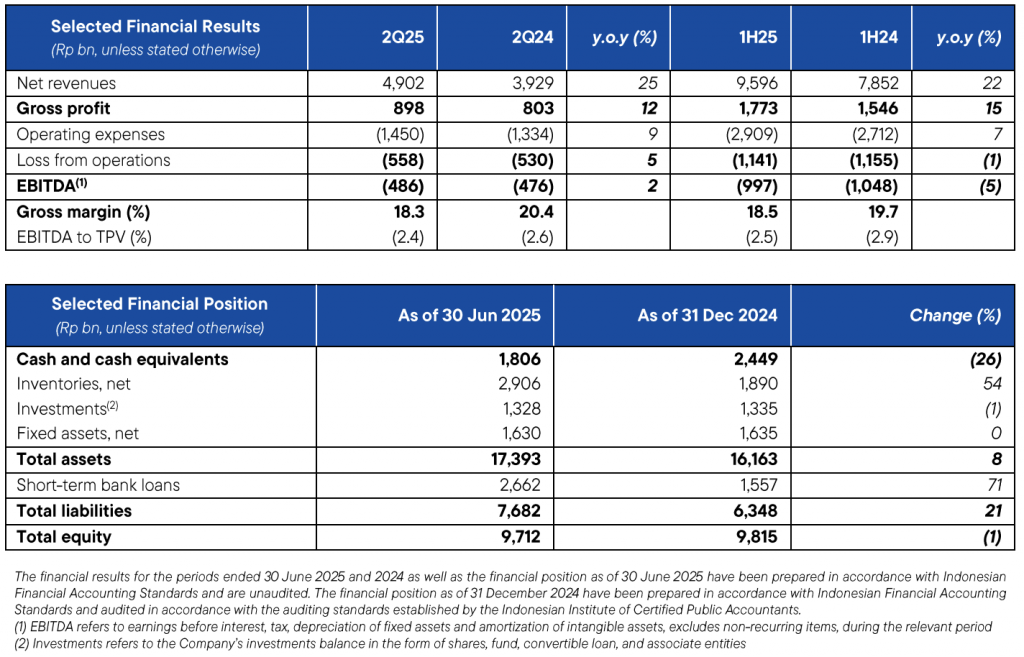

Revenue & Profitability

Consolidated Net Revenues recorded 25% y.o.y growth from Rp3,929 bn in 2Q24 to Rp4,902 bn in 2Q25, and by 22% y.o.y growth from Rp7,852 bn in 1H24 to Rp9,596 bn in 1H25, driven by the improvement across all business segments, especially in the consumer electronics category, which benefited from higher smartphone sales volume, stronger performance in the OTA business, and an expanding consumer electronics physical stores network. However, in response to intensified market competition in the first half of 2025, the Company enhanced its promotional efforts—primarily in the 1P Retail segment, resulted in a slight decline in overall consolidated Gross Margin to 18.5% in 1H25.

Throughout the period, the Company still further improved its operational excellence which resulted in better cost structure, reflected from lower consolidated Operating Expenses as percentage of TPV from 7.5% in 1H24 to 7.2% in 1H25, mainly supported by the lower consolidated general and administrative expenses as percentage of TPV from 5.0% in 1H24 to 4.8% in 1H25. With the improvement of profitability and better overall cost structure, the Company continued to improve its performance, reflected by the improved consolidated EBITDA as percentage of TPV from -2.9% in 1H24 to -2.5% in 1H25, an improvement of 40bps y.o.y.

Cash Flows

Net cash used in operating activities was recorded at Rp2,557 bn in 1H25, mainly used for cash payments to suppliers and cash payments of operating expenses partly offset by cash receipts from customers. Net cash used in investing activities was recorded at Rp122 bn in 1H25, mainly used for acquisition of fixed assets. Meanwhile, net cash provided by financing activities was recorded at Rp2,036 bn in 1H25, mainly contributed by the cash receipts of short-term bank loans, partly offset by cash payments of short-term bank loans. Therefore, the Company’s consolidated Cash and Cash Equivalents position was recorded at Rp1,806 bn as of 30 June 2025 compared to Rp2,449 bn as of 31 December 2024.

CORPORATE ACTION(S)

On 11 June 2025, the Company successfully held an AGMS for the financial year 2024, which was then followed by an EGMS in Jakarta.

At the AGMS, the Company obtained shareholders’ approval for several significant resolutions, including the approval for the Board of Directors’ Report and the Company’s Annual Report for the financial year ended 31 December 2024. In line with this, the meeting also approved the remuneration, honorarium and/or other benefits for the Board of Directors and the Board of Commissioners for the financial year 2025. Further, it authorized the appointment of a Public Accountant and/or Public Accounting Firm to audit the Company’s financial statements for the year ending 31 December 2025.

In terms of governance, the shareholders also approved the changes to the composition of the Company’s Board of Commissioners, whereby Imron Hendrata was officially appointed as the new Vice President Commissioner. Additionally, the Company reported on the realization of the use of proceeds from the Initial Public Offering (IPO) as of 31 December 2024, reaffirming its commitment to transparency and responsible capital management. These resolutions reflect the Company’s dedication to maintain strong corporate governance, ensuring long-term value creation, and upholding the trust of its shareholders.

Meanwhile, during the EGMS, the Company secured approval from independent shareholders for the plan to Increase Capital Without Pre-emptive Rights (Penambahan Modal Tanpa Hak Memesan Efek Terlebih Dahulu/PMTHMETD) in the framework of the management and employee stock option plan (MESOP) program with a maximum amount of 4,000,000,000 shares or 2.99% of the issued and fully paid-up capital in the Company.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG)

As a pioneer in integrated omnichannel commerce and lifestyle, the Company reaffirms its commitment to long-term value creation through sustainable practices. Through Blibli Tiket Action program, the Company embodies this commitment by promoting ESG (Environmental, Social, and Governance) initiatives and encouraging active stakeholder participation during the first half of 2025.

Environmental Focus

The Company strengthened its environmental impact through customer engagement and employee-driven initiatives:

- Take-Back Packaging Program: encourages customers to return used packaging, contributing to tree-planting efforts;

- Green Delivery: reduces carbon emissions through the usage of electric vehicles;

- Trade-In Expansion: includes lifestyle items like shoes, extending the life of products and minimizing waste;

- Misi Tanam Pohon: enables customers to donate Rp1,000 per transaction for reforestation efforts;

- Kaizen Competition: fosters a culture of continuous improvement and operational efficiency; and

- One Step Further Program: promotes circular fashion through employee-led donations of gently used shoes to Desa Mendut, Magelang, Central Java.

Social Impact

The Company supported underprivileged children through educational and inspirational initiatives:

- Blizania Roleplay Activity: introduced children from Yayasan Sanggar Anak Kita (SAKA) to the digital world and e-commerce through learning-based play; and

- Film Screening – “Jumbo”: collaborated with Sandiaga Uno and YAMSA, the screening aimed to inspire and build self-confidence among young viewers.

Governance Excellence

The Company demonstrated a strong commitment to responsible digital governance:

- Retained its PCI DSS 4.0 Merchant Level 1 certification: the highest standard for data security in the e-commerce credit card billing systems, demonstrating a strong commitment to responsible digital governance.

BUSINESS PROSPECTS

We enter the second half of 2025 with clarity and conviction. Our omnichannel strategy remains at the core of our growth ambitions, as we blend digital convenience with offline engagement to create a truly differentiated customer experience. Investments in logistics—most notably the Marunda warehouse—will further streamline our fulfilment network, enhance service reliability, and open avenues for incremental revenue. By continuously refining our value propositions and operational capabilities, we are well-positioned to capitalize on emerging opportunities and deliver consistent, sustainable impact for all stakeholders.

– End –