30th April 2025 | Jakarta, Indonesia

PT Global Digital Niaga Tbk (the “Company”; IDX: BELI), a pioneer and leading omnichannel commerce and lifestyle ecosystem in Indonesia focusing on serving digitally connected retail and institutions consumers, today announced its first quarter earnings results for the year 2025.

KEY HIGHLIGHTS

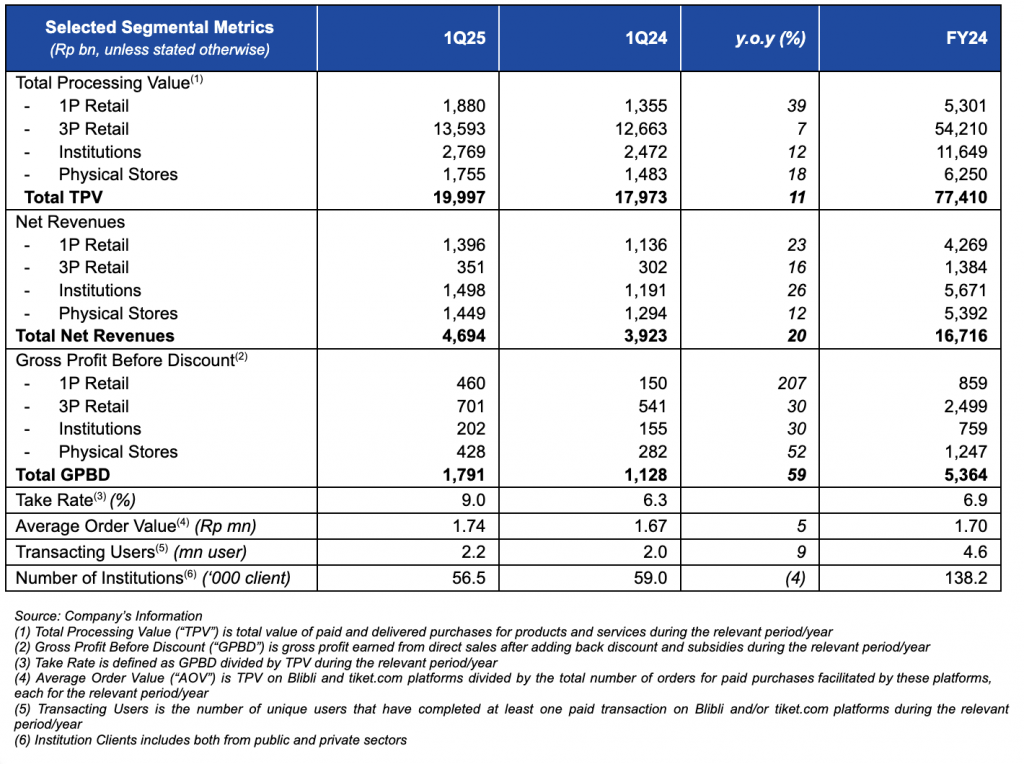

- Consolidated Net Revenues grew by 20% y.o.y in 1Q25 with healthy double-digit growth trajectory across all business segments during the period.

- Take Rate expanded further from 6.3% in 1Q24 to 9.0% in 1Q25, on the back of Take Rate increase across all segments, especially in 1P Retail and Physical Stores segments. This was a result from 59% y.o.y growth in Gross Profit Before Discount (GPBD), including 207% y.o.y growth of GPBD in 1P Retail segment during the period. Meanwhile, consolidated Gross Margin remained relatively stable at 18.6% in 1Q25.

- Better cost structure reflected by the lower consolidated Operating Expenses as percentage of TPV from 7.7% in 1Q24 to 7.3% in 1Q25, resulted in an improved performance of consolidated EBITDA as percentage of TPV by 60bps y.o.y, from -3.2% in 1Q24 to -2.6% in 1Q25.

- Further adjusted published rate for its third-party sellers to be in line with market starting March this year, which is expected to further boost margin optimization strategy.

- Added a total of 11 new consumer electronics stores throughout 1Q25, including the addition of new monobrand stores for hello (Apple), Samsung and newly launched Huawei brands, as well as multibrand Blibli stores. As of the end of March 2025, the Company operated a total of 215 consumer electronics stores, as well as 60 premium supermarkets outlets and 35 home and living experience centers.

MANAGEMENT STATEMENT(S)

Kusumo Martanto – CEO & Co-Founder

“We entered 2025 with strong motivation to continue the positive trend we recorded during last year, with the aim to provide meaningful impact and value, as so to become the solution company for all our customers, both consumers, businesses, and brand partners.

Despite strong headwinds from global economic challenges that affected domestic business climate during the first quarter of 2025, we tried to navigate ourselves to transform, adapt and grow with the market dynamics, positioned ourselves as a true omnichannel ecosystem that is present anywhere and anytime to solve our stakeholders’ problems in the most cost-effective yet impactful ways. Our strategy remains consistent to enhance the scale of Blibli, tiket.com, Ranch Market and Dekoruma as unified pillars of growth.

Every one of us, across all divisions and teams, fully understood that the strategies set forth can only be accomplished with growth mindset, professionalism, resilience, and trust; we must have the audacity to take bold actions with calculated risks and execute with speed and determination. By putting forward these attitudes and focusing on our resources, we are confident to deliver even better results for the year ahead.”

Ronald Winardi – CFO

“We are happy with our overall net revenues and gross profit growth achievement in 1Q25, despite challenging market condition. Our 1P Retail segment led the way in 1Q25 improvement, delivering more than 200% growth in GPBD at much higher take rate than last year. We believe that the structural improvements shall continue.”

KEY OPERATIONAL HIGHLIGHTS

BUSINESS SEGMENTS OVERVIEW

Below is an overview from each of the Company’s business segment during the first quarter of 2025 (1Q25) compared to the first quarter of 2024 (1Q24) period.

1P Retail

1P Retail segment undertakes the Company’s business through its B2C online commerce platform for first party (1P) products and services from various categories.

GPBD for this segment recorded a significant 207% y.o.y growth in 1Q25 to Rp460 bn during the period. The improved GPBD performance was mainly contributed by the Company’s strategy to focus more on higher margin product mix, including smartphones as well as sports and wellness products. In addition, the Company also recorded positive contributions from Dekoruma, which was acquired by the Company in Jun 2024. Overall, TPV and Net Revenues for this segment grew by 39% and 23% y.o.y in 1Q25, to Rp1,880 bn and Rp1,396 bn, respectively.

In order to drive its 1P Retail segment, the Company has built and developed a vast network of order fulfillment, logistics and last-mile delivery infrastructure, using hub-and-spoke model, supported by 13 warehouses with a total warehouse area of 202,000 square meters, as well as 23 distribution centers (hubs), enabling the Company to offer 2-hour delivery service of approximately 400,000 SKUs in 48 cities nationwide. The new warehouse in Marunda, West Java, has also started to operate since October 2024 and is expected to strengthen the Company’s logistics and supply chain capabilities, including for the Fulfillment at Speed (FAS) and Fulfillment by Blibli (FBB) services.

To support its home and living category, the Company also manages 35 home and living experience centers operated by Dekoruma, to expand consumer omnichannel touchpoints in this category.

3P Retail

3P Retail segment predominantly records the Company’s platform revenue generated from sales of products and services of various categories from third party (3P) sellers through its online commerce and online travel agent (OTA) platforms.

GPBD for this segment recorded a healthy 30% y.o.y growth in 1Q25 to Rp701 bn. The improved GPBD performance was mainly driven by higher contributions from the Company’s OTA business, which benefited from higher flight seats booked on the back of Ramadhan during the period. Overall TPV and Net Revenues for this segment grew by 7% and 16% y.o.y in 1Q25, to Rp13,593 bn and Rp351 bn, respectively.

As at the end of March 2025, the Company’s OTA platform – tiket.com offered a variety of products and services, including flight tickets from 132 domestic and international airlines serving more than 221 countries, regions, and territories, providing more than 3.6 million accommodation options, including 2.2 million options of alternative accommodations, and offering more than 77,700 activities in tourist destinations and more than 4,100 events worldwide.

Institutions

Institutions segment includes the Company’s business through its B2B and B2G platforms for 1P and 3P products and services serving private and public-sector institutions across Indonesia.

GPBD for this segment also recorded a healthy growth of 30% y.o.y in 1Q25 to Rp202 bn. The improved GPBD performance was mainly contributed from higher sales volume of smartphone product category to institution clients. During the first quarter of 2025, this segment managed to improve further the quality of its clients, reflected by higher spending per institutional client by 17% to Rp49.0 mn. Overall TPV and Net Revenues for this segment grew by 12% and 26% y.o.y in 1Q25, to Rp2,769 bn and Rp1,498 bn, respectively.

To support the Institutions segment, the Company operates Blibli SIPLah (School Procurement System) platform since 2019 and Blibli for Business platform since 2021. In addition, the Company has also been appointed as one of the main suppliers for national procurement projects through the e-catalog platform, an online shopping application developed by the Government Goods and Services Procurement Policy Agency (LKPP) since 2022.

As at the end of March 2025, the Company’s Institutions business segment has served more than 56,500 institutional clients, with a continuously growing of monetization rate from 48% in 1Q24 to 54% in 1Q25, reflecting the increasing trust of corporate clients to the services provided by the Company.

Physical Stores

Physical Stores segment records the Company’s business in physical consumer electronics stores collaborating with leading global consumer electronics brand principals, as well as premium grocery supermarkets chain operated by 70.6%-owned Subsidiary, PT Supra Boga Lestari Tbk (“Ranch Market”; IDX: RANC).

GPBD for this segment recorded a strong 52% y.o.y growth in 1Q25 to Rp428 bn. The improved GPBD performance was mainly driven by the higher smartphone sales volume on the back of new products launch and the continued expansion of the Company’s consumer electronic physical stores, including the addition of new monobrand stores for hello (Apple), Samsung and newly launched Huawei brands, as well as multibrand Blibli stores. Overall TPV and Net Revenues for this segment grew by 18% and 12% y.o.y in 1Q25, to Rp1,755 bn and Rp1,449 bn, respectively.

With the additional of 11 new consumer electronics stores throughout period, the Company operated a total of 215 consumer electronics stores as at the end March 2025, which consists of 117 monobrand stores and 98 multibrand stores. In addition, the Company also managed 60 premium supermarket outlets operated by Ranch Market.

CONSOLIDATED FINANCIAL PERFORMANCES

MANAGEMENT DISCUSSION & ANALYSIS

Below are brief descriptions of the Company’s consolidated financial performances during the first quarter of 2025 (1Q25) compared to the first quarter of 2024 (1Q24) period.

Revenue & Profitability

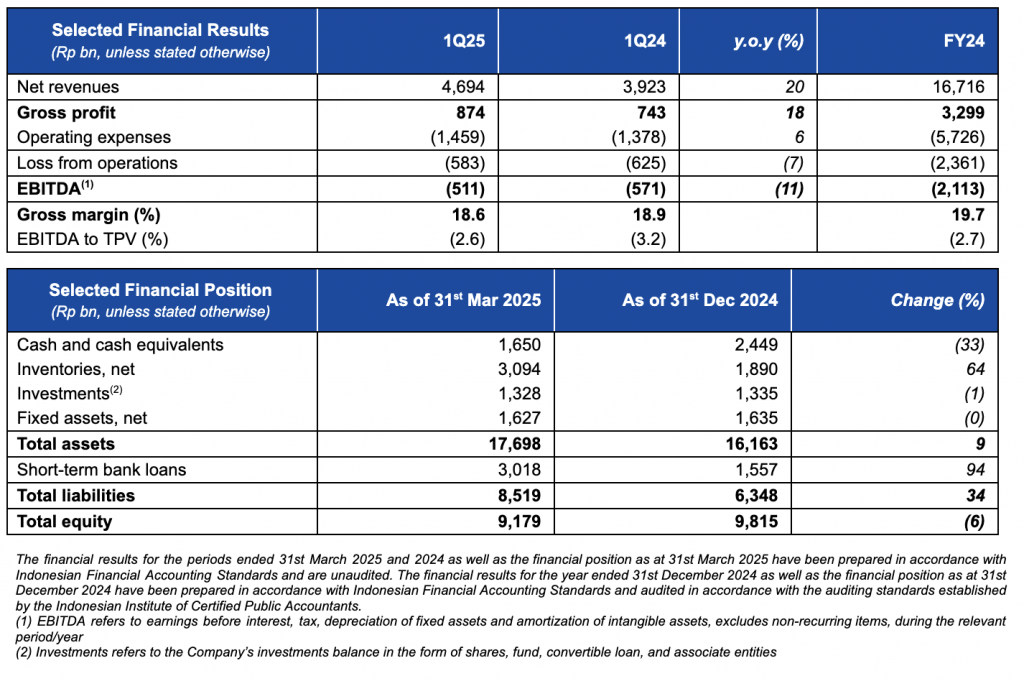

Consolidated Net Revenues recorded 20% y.o.y growth from Rp3,923 bn in 1Q24 to Rp4,694 bn in 1Q25, with significant growth in 1P Retail segment and healthy double-digit growth trajectory in other business segments, mainly driven by strong performance in the consumer electronics category on the back of higher smartphone sales volume especially with the new products launch, higher contribution from flights seats booked during Ramadhan period in OTA business, as well as growing home & living business through Dekoruma. The Company also managed to record a relatively stable consolidated Gross Margin at 18.6% in 1Q25.

Throughout the period, the Company has further improved its operational excellence which resulted in better cost structure, reflected from lower consolidated Operating Expenses as percentage of TPV in 1Q25 at 7.3%, mainly supported by the lower consolidated general and administrative expenses as percentage of TPV from 5.1% in 1Q24 to 4.8% in 1Q25. With the improvement of profitability and better overall cost structure, the Company continued to improve its performance, reflected by the improved consolidated EBITDA as percentage of TPV from -3.2% in 1Q24 to -2.6% in 1Q25, an improvement of 60bps y.o.y.

Cash Flows

Net cash used in operating activities was recorded at Rp2,095 bn in 1Q25, mainly used for cash payment to suppliers partly offset by cash receipts from customers. Net cash used in investing activities was recorded at Rp43bn in 1Q25, mainly used for acquisition of fixed assets. Meanwhile, net cash provided by financing activities was recorded at Rp1,339 bn in 1Q25, mainly contributed by the proceeds from short-term bank loans. Therefore, the Company’s consolidated Cash and Cash Equivalents position was recorded at Rp1,650 bn as of 31st March 2025 compared to Rp2,449 bn as of 31st December 2024.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG)

As a pioneer in building an integrated omnichannel commerce and lifestyle ecosystem, the Company remains committed to delivering long-term value by actively driving positive impact. This includes taking tangible steps to manage environmental sustainability, empower employees and communities, and reinforce corporate governance practices to uphold transparency, accountability, and trust.

The Company continues to enhance its Environmental, Social, and Governance (ESG) impact through the “Blibli Tiket Action”—an overarching program designed to integrate sustainability across operations. Key initiatives implemented under this program include:

- Adoption of FSC-certified cardboard in order fulfillment to support responsible sourcing practices;

- Optimization of internal waste management system to increase the volume of reused and recycled materials;

- Introduction of “Green Delivery” service utilizing electric vehicles (EVs) to reduce carbon emissions and improve air quality;

- Implementation of “Take-Back” packaging program, empowering customers to return used packaging while supporting tree-planting efforts;

- Launch of the “Misi Tanam Pohon” feature, allowing customers to donate Rp1,000 per transaction to reforestation efforts, making sustainable contributions more accessible;

- Expanded the “Langkah Membumi Festival”, a public platform aimed at delivering impactful, inclusive, and interactive sessions on sustainability, while fostering meaningful cross-sector collaboration;

- Strengthening employee capabilities through targeted training and development programs to build a future-ready workforce and foster cross-functional collaboration;

- Execution of corporate social responsibility (CSR) initiatives, encouraging employee participation in fundraising and volunteering; and

- Advancement of corporate governance through prioritizing secure and reliable data management, adhering to regulations and certified standards, including ISO 27001:2022 and ISO 27701:2019, for information security and data privacy.

BUSINESS PROSPECTS

We anticipate that the economic condition and business climate will likely remain challenging for the year. Hence, we will strive on further innovations and unlocking potential synergies within the ecosystem to boost organic growth. Our discipline focus on cost efficiencies and continuous optimization strategies on the product categories mix for the past years have placed us in a stronger and more flexible position, allowing us to be more flexible in balancing business growth and healthy margin. Through the right implementation of omnichannel strategy as a solution, loyalty program as ecosystem enhancement, and our expanding distribution capabilities, we believe that the Company is well-positioned to deliver positive and sustainable performance throughout the year.