27th March 2025 | Jakarta, Indonesia

PT Global Digital Niaga Tbk (the “Company”; IDX: BELI), a pioneer and leading omnichannel commerce and lifestyle ecosystem in Indonesia focusing on serving digitally connected retail and institutions consumers, today announced its full year earnings results for the year 2024.

KEY HIGHLIGHTS

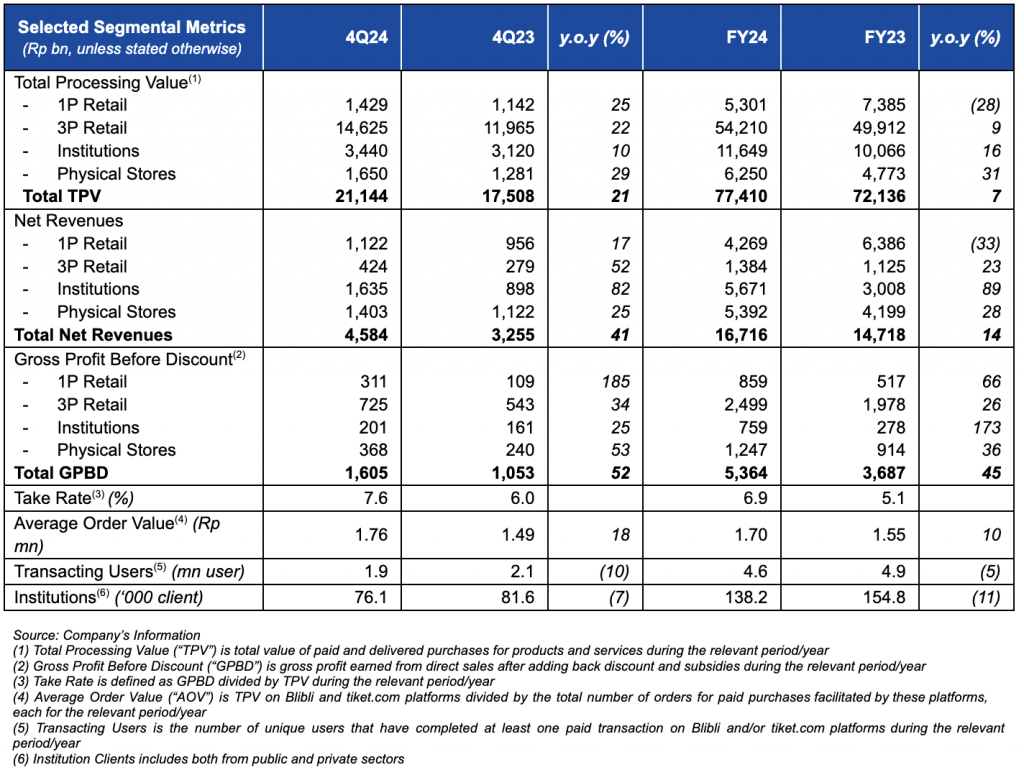

- Consolidated Net Revenues grew by 41% and 14% y.o.y in 4Q24 and FY24, respectively, with significant 89% y.o.y improvement in the Institutions segment during FY24, while other segments maintained strong double-digit growth trajectory in the fourth quarter.

- Take Rate expanded further from 5.1% in FY23 to 6.9% in FY24 and reached as high as 7.6% in 4Q24. This was a result from 45% y.o.y growth in Gross Profit Before Discount (GPBD) in FY24. Notably, GPBD in the Institutions segment grew strongly by 173% y.o.y, while that of 1P Retail segment increased significantly by 66% y.o.y. Consolidated Gross Margin also improved further from 16.3% in FY23 to 19.7% in FY24, an improvement of 340bps y.o.y.

- Better cost structure reflected by the lower consolidated Operating Expenses as percentage of TPV from 8.3% in FY23 to 7.4% in FY24, resulted in an improved performance of consolidated EBITDA as percentage of TPV by 190bps y.o.y, from -4.6% in FY23 to -2.7% in FY24.

- Introduced Unified Membership, a continuation of the Blibli Tiket ecosystem integration which allows the Company to provide multiple benefits across platforms and more personalization for users.

- Completed the acquisition of Dekoruma, which is expected to become strategic growth trajectory for the Company’s home and living product category.

- Completed Rp2.25 tn capital raising through Capital Increase Without Pre-emptive Rights (Penambahan Modal Tanpa Hak Memesan Efek Terlebih Dahulu/PMTHMETD).

- Construction of Blibli’s new warehouse in Marunda completed at the end of September 2024, where operation has started since October 2024 to strengthen the Company’s logistics and fulfillment capabilities.

- Expanded omnichannel strategy by deepening partnership with Huawei brand with the opening of multiple Huawei monobrand stores throughout the year.

- Added a total of 38 new consumer electronics stores throughout FY24, wherein 12 stores in the fourth quarter, including the addition of new monobrand stores for hello (Apple) and Samsung brands as well as multibrand Blibli stores. As of the end of 2024, the Company operated a total of 204 consumer electronics stores, as well as 60 premium supermarkets outlets and 32 home and living experience centers.

MANAGEMENT STATEMENT(S)

Kusumo Martanto – CEO & Co-Founder

“Despite a year of headwinds, economic uncertainty, and shifting market dynamics, we remained disciplined, focusing squarely on what we understand best: delivering value to our customers. By capitalizing on key opportunities, strengthening synergies, and driving meaningful innovations, we have reinforced the robustness of our entire ecosystem. Our goal has always been straightforward—providing seamless, relevant shopping experiences tailored to customers’ evolving needs and lifestyles.

One standout initiative has been our strategic investment in the application of artificial intelligence (AI) and machine learning (ML). This prudent step has significantly enhanced product and operational performance by improving buyer-seller interactions, refining customer targeting, achieving cost efficiencies, and simplifying product discovery. Another strategic initiative has been the integration of Dekoruma into our ecosystem, positioning us advantageously to capture growing demand within Indonesia’s home and living market, particularly in the middle-income segment.

Having a variety of platforms under one ecosystem provides us with a durable competitive advantage through cross-selling flexibility. Our Unified Membership feature offers customers a seamless login experience and access to extensive benefits across the ecosystem, complementing the earlier introduction of our Unified Loyalty Program—Blibli Tiket Rewards. Additionally, our ongoing commitment to omnichannel retail, demonstrated by expanding our physical footprint and adding strategic partnerships—notably with Huawei—underscores our dedication to meeting the customer wherever they choose to shop.

The Blibli Tiket ecosystem is strategically positioned to navigate and capitalize on market fluctuations. Our emphasis on operational efficiency and thoughtful technological innovation, supported by clear objectives and a coherent strategic roadmap, reinforces our optimism. We remain committed to sustainably outperforming in a fiercely competitive environment.”

Ronald Winardi – CFO

“Our operating performance continued improving with 34% y.o.y reduction in operating loss in FY24, driven by take rate expansion reached as high as 7.6% in 4Q24 as well as reduction of consolidated operating expenses. The improving margins trend poised for better growth in the future.”

KEY OPERATIONAL HIGHLIGHTS

BUSINESS SEGMENTS OVERVIEW

Below is an overview from each of the Company’s business segment during the fourth quarter of 2024 (4Q24) compared to the fourth quarter of 2023 (4Q23) period, and the full year of 2024 (FY24) compared to the full year of 2023 (FY23).

1P Retail

1P Retail segment undertakes the Company’s business through its B2C online commerce platform for first party (1P) products and services from various categories.

GPBD for this segment recorded 66% y.o.y growth in FY24 to Rp859 bn, with strong 185% y.o.y growth performance in 4Q24 and significant Take Rate expansion for this segment. The improved GPBD performance was mainly contributed by the Company’s strategy to rationalize categories mix in this segment during the year by pushing higher margin products, including consumer electronics and consumer goods. In addition, the Company also started to record contributions from Dekoruma, which was newly acquired by the Company in Jun 2024.

In order to drive its 1P Retail segment, the Company has built and developed a vast network of order fulfillment, logistics and last-mile delivery infrastructure, using hub-and-spoke model, supported by 13 warehouses with a total warehouse area of 202,000 square meters, as well as 23 distribution centers (hubs), enabling the Company to offer 2-hour delivery service of approximately 400,000 SKUs in 48 cities nationwide. The new warehouse in Marunda, West Java, has also started to operate since October 2024 and is expected to strengthen the Company’s logistics and supply chain capabilities, including for the Fulfillment at Speed (FAS) and Fulfillment by Blibli (FBB) services.

To support its home and living category, the Company also manages 32 home and living experience centers operated by the recently acquired Dekoruma, to expand consumer omnichannel touchpoints in this category.

3P Retail

3P Retail segment predominantly records the Company’s platform fees generated from sales of products and services of various categories from third party (3P) sellers through its online commerce and online travel agent (OTA) platforms.

GPBD for this segment continued to grow by 34% and 26% y.o.y in 4Q24 and FY24, to Rp725 bn and Rp2,499 bn, respectively. The improved GPBD performance was mainly driven by higher contributions from the Company’s OTA business, which benefited from high demand in the travel and lifestyle categories, especially on the accommodation products which provides higher margin. Overall Net Revenues for this segment grew by 52% y.o.y to Rp424 bn in 4Q24 and by 23% y.o.y to Rp1,384 bn in FY24.

As at the end of 2024, the Company’s OTA platform – tiket.com offered a variety of products and services, including flight tickets from 127 domestic and international airlines serving more than 225 countries, regions, and territories, providing more than 3.6 million accommodation options, including 2.2 million options of alternative accommodations, and offering more than 77,100 activities in tourist destinations and more than 4,100 events worldwide. In 2024, tiket.com experienced higher contributions from live-concert ticket sales on the back of increasing offline events demand.

Institutions

Institutions segment includes the Company’s business through its B2B and B2G platforms for 1P and 3P products and services serving private and public-sector institutions across Indonesia.

GPBD for this segment continued to record significant growth by 25% and 173% y.o.y in 4Q24 and FY24, to Rp201 bn and Rp759 bn, respectively. The improved GPBD performance was mainly contributed from higher sales volume of smartphone product category to institution clients. Throughout the year, this segment also managed to improve further the quality of its clients, reflected by higher spending per institutional client by 30% y.o.y to Rp84.3 mn per client in FY24. This resulted in higher TPV and Net Revenues by 16% and 89% y.o.y in FY24, respectively.

To support the Institutions segment, the Company launched the Blibli SIPLah (School Procurement System) platform in 2019, in collaboration with the Ministry of Education, Culture, Research, and Technology of the Republic of Indonesia, followed by the launching the Blibli for Business platform in 2021. In addition, the Company has been appointed as one of the main suppliers for national procurement projects through the e-catalog platform, an online shopping application developed by the Government Goods and Services Procurement Policy Agency (LKPP) since 2022.

By the end of 2024, the Company’s Institutions business segment has served more than 138,000 institutional clients, with a continuously growing of monetization rate from 30% in FY23 to 49% in FY24, reflecting the increasing trust of corporate clients to the services provided by the Company.

Physical Stores

Physical Stores segment records the Company’s business in physical consumer electronics stores collaborating with leading global consumer electronics brand principals, as well as premium grocery supermarkets chain operated by 70.6%-owned Subsidiary, PT Supra Boga Lestari Tbk (“Ranch Market”; IDX: RANC).

GPBD for this segment grew rapidly by 53% and 36% y.o.y in 4Q24 and FY24, to Rp368 bn and Rp1,247 bn, respectively. The improved GPBD performance was mainly driven by the increase in TPV and Net Revenues in this segment as the Company continued expanding its consumer electronics physical stores, including the addition of new stores for hello (Apple) and Samsung brands, as well as new monobrand stores for Huawei brand.

With the additional of 38 new consumer electronics stores throughout FY24, wherein 12 stores in the fourth quarter, including the addition of new monobrand stores for hello (Apple), Samsung and Huawei brands as well as multibrand Blibli stores, the Company operated a total of 204 consumer electronics stores as at the end of 2024, which consists of 112 monobrand stores and 92 multibrand stores. In addition, the Company also managed 60 premium supermarket outlets operated by Ranch Market.

CONSOLIDATED FINANCIAL PERFORMANCES

MANAGEMENT DISCUSSION & ANALYSIS

Below are brief descriptions of the Company’s consolidated financial performances during the fourth quarter of 2024 (4Q24) compared to the fourth quarter of 2023 (4Q23) period, and the full year of 2024 (FY24) compared to the full year of 2023 (FY23).

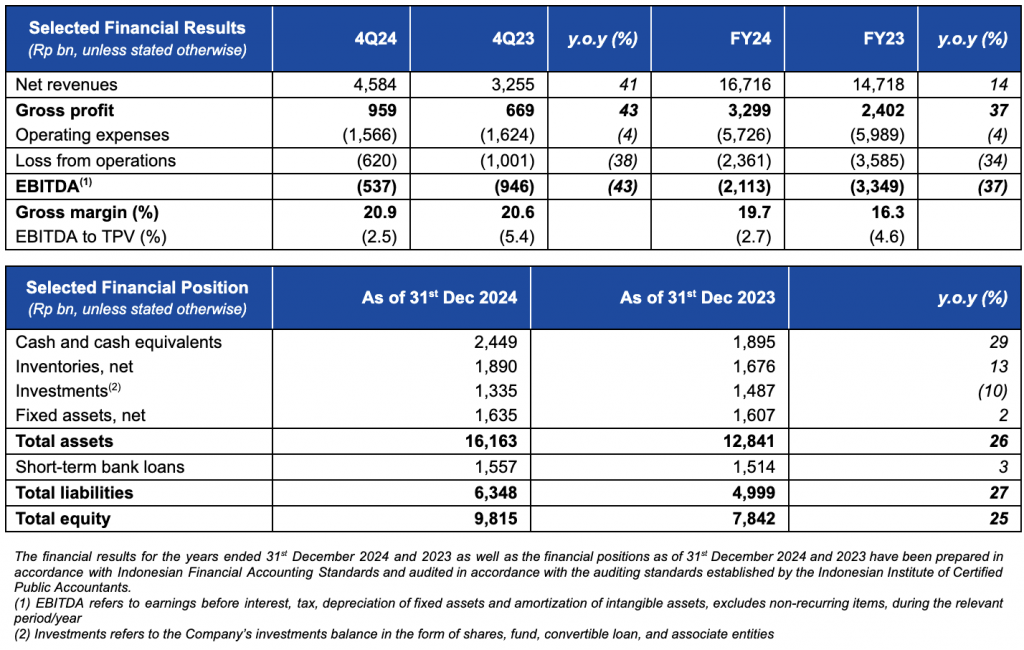

Revenue & Profitability

Consolidated Net Revenues recorded 14% y.o.y growth from Rp14,718 bn in FY23 to Rp16,716 bn in FY24, with robust growth of 41% y.o.y in 4Q24 to Rp4,584 bn. This was mainly driven by strong performance in the consumer electronics category on the back of higher smartphone sales volume, higher contribution from OTA business, as well as growing home & living business. Furthermore, the Company also managed to improve its consolidated Gross Margin from 16.3% in FY23 to 19.7% in FY24, an improvement of 340bps y.o.y, which was contributed by the Gross Margin expansion in all of the business segments.

Throughout the year, the Company has successfully managed to further improve its operational excellence which resulted in better cost structure, reflected from lower consolidated Operating Expenses as percentage of TPV in FY24 at 7.4%, mainly supported by the lower advertising & marketing expenses as percentage of TPV in FY24 at 1.0%, as well as lower consolidated general and administrative expenses as percentage of TPV in FY24 at 4.8%. With the improvement of consolidated Gross Margin and better overall cost structure, the Company continued to improve its performance, reflected by the improved consolidated EBITDA as percentage of TPV from -4.6% in FY23 to -2.7% in FY24, an improvement of 190-bps y.o.y.

Cash Flows

Net cash used in operating activities was recorded at Rp2,468 bn in FY24, improved from Rp3,788 bn in FY23. Meanwhile, the increase of net cash used for investing activities to Rp1,078 bn recorded in FY24 was mainly used for the purchase transaction of Dekoruma in the second quarter 2024. Net cash provided by financing activities was recorded at Rp4,100 bn in FY24, mainly contributed by the Capital Increase Without Pre-emptive Rights (PMTHMETD) carried out in the fourth quarter 2024. The margin improvement along with reduced operating expenses contributed to a sustained operating cash flow, leading to the Company’s consolidated cash and cash equivalents position to Rp2,449 bn as of 31st December 2024.

CORPORATE ACTION(S)

In June 2024, the Company completed the purchase of approximately 99.83% ownership of PT Dekoruma Inovasi Lestari (Dekoruma), a leading omnichannel home and living retail and interior design company in Indonesia. Following this transaction, together with Dekoruma, the home and living category will become an additional pillar of the Company’s growth, capitalizing on the increasing demand for well-designed and affordable home and living products for the middle-income segment in Indonesia.

In October 2024, the Company carried out a Capital Increase Without Pre-emptive Rights (PMTHMETD) by issuing 4,900,240,527 new shares representing 3.98% of the Company’s issued and paid-up capital with an exercise price of Rp460 per share. The amount of capital raised by the Company through this PMTHMETD was Rp2.25 trillion.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG)

As a pioneer in integrated omnichannel commerce and lifestyle ecosystem, the Company strengthens its commitment to sustainability aspect by launching “Blibli Tiket Action”, a comprehensive program advancing ESG-focused initiatives.

Throughout 2024, Blibli Tiket Action has carried out several initiatives, including:

- Pioneered “Green Delivery”, by providing customers with a new shipping option using electric vehicles for the Company’s instant and same day delivery service;

- Launched “Misi Tanam Pohon” feature, enabling customer to contribute to tree plantation program with just Rp1,000 for each transaction;

- Promoted “CollaborAction” program, a media for employee to initiate ideas related to sustainability;

- Held “BOLD Festival” as a flagship training initiative to develop employees’ skills and a growth mindset; and

- Established “Langkah Membumi Festival”, a public event to deliver impactful, inclusive, and engaging sessions around sustainability, fostering collaboration among the public, large enterprises, SMEs, and local communities

The company has successfully maintained its ISO/IEC 27001 certification and managed to comply to the newer edition: 2022 for the Information Security Management System. The company also has certified ISO/IEC 27701:2019 for Privacy Information Management System that show the Company’s strong commitment in maintaining the highest privacy and data protection standards.

Furthermore, the Company’s sustainability practices have been awarded with “Strategy into Performance Execution Excellence” by the SPEx2® Award, received “Change the World Award” by Fortune Indonesia, and recognized for its Langkah Membumi Program by IDX Channel Anugerah ESG 2024. These awards and recognitions reflect the Company’s commitment into action to create greater impacts toward sustainable practices.

BUSINESS PROSPECTS

Looking forward, the Company’s mission is clear: to increase public awareness of the value the ecosystem brings—especially through integrated offerings like Blibli Tiket Rewards and Unified Membership. By continuously enhancing and refining the value proposition, the Company aims to deepen its customer relationships and reinforce its position as their ecosystem of choice.

The Company also recognizes that competition continues to intensify. The disciplined approach is two pronged: One, emphasize margin optimization, cost leadership, and synergies across platforms. Maintaining this balance between market-share expansion and achieving profitability is critical. Two, continue to build out and extend our competitive advantages through full spectrum value chain partnerships with brand, the Company’s leading omnichannel retail, and peerless customer service. The Company is convinced this approach will lead not only to steady growth but also sustainable profitability, ultimately allowing the Company to navigate market changes effectively and deliver long-term value to all stakeholders.