30th April 2024 | Jakarta, Indonesia

PT Global Digital Niaga Tbk (the “Company”; IDX: BELI), a pioneer and leading omnichannel commerce and lifestyle ecosystem in Indonesia focusing on serving digitally connected retail and institutions consumers, today announced its first quarter earnings results for the year 2024.

KEY HIGHLIGHTS

- Consolidated Net Revenues recorded 2% y.o.y growth in 1Q24. The Company’s growth focus remains selective in categories that are higher in relative margin, faster turnover and strategic to its competitive positioning.

- Take Rate continued to expand from 4.9% 1Q23 to 6.3% in 1Q24, resulting in 29% y.o.y growth in Gross Profit Before Discount (GPBD).

- Consolidated Gross Margin improved from 15.1% in 1Q23 to 18.9% in 1Q24, an increase of 390-bps y.o.y, mainly attributed to the Gross Profit expansion in most of the business segments.

- Cost structure continued to improve further, reflected by the lower consolidated Operating Expenses as percentage of TPV from 8.1% in 1Q23 to 7.7% in 1Q24. This resulted in an improved performance of consolidated EBITDA as percentage of TPV by 140-bps, from -4.6% in 1Q23 to -3.2% in 1Q24.

- The Company has implemented adjustments of its published rate for its third-party sellers to be in line with the market starting January this year to further enhance its margin optimization strategy.

- The construction progress of the Company’s new warehouse in Marunda has reached ~85% as at the end of March 2024 and is projected to start operating in stages in the fourth quarter of this year.

- The Company continued amplifying omnichannel strategy with an additional of 6 consumer electronic stores throughout the first quarter of 2024, which brings a total of 172 consumer electronics stores operated by the Company, as well as 63 premium supermarkets outlets as of the end of March 2024.

MANAGEMENT STATEMENT(S)

Kusumo Martanto – CEO & Co-Founder

“As we reflect on the first quarter of 2024, our mission, set forth at the time of our IPO, has not only remained constant but has also been the driving force behind our endeavors: solidifying our position as the commerce ecosystem of choice for consumers and institutions. Each step taken and every innovation introduced has been in pursuit of this unwavering objective, further affirming our commitment to our customers and partners.

In the first quarter of this year, general consumer spending was soft and our B2C navigated it through categories selective growth strategy, including further expansion of our physical customer touchpoints to strengthen our omnichannel approach. Despite the headwind, our Gross Profit expansion continues. Meanwhile, our strategic focus on margin optimization, cost leadership, and ecosystem excellence has driven improved productivity and efficiency, leading to a reduction in losses.

Equally important has been the dedication, ownership, and relentless efforts of our employees, whose contributions have been vital to our achievements. Fueled by a spirit of collaboration, innovation, and continuous improvement, we are poised to face upcoming business challenges and maintain our steady advance toward profitability.”

Ronald Winardi – CFO

“Commercial discipline continued in the first quarter of this year, resulting in 29% y.o.y expansion of consolidated Gross Profit despite challenging market backdrop. In combination with 20% y.o.y lower selling expense, losses reduction continues, inch by inch, row by row.“

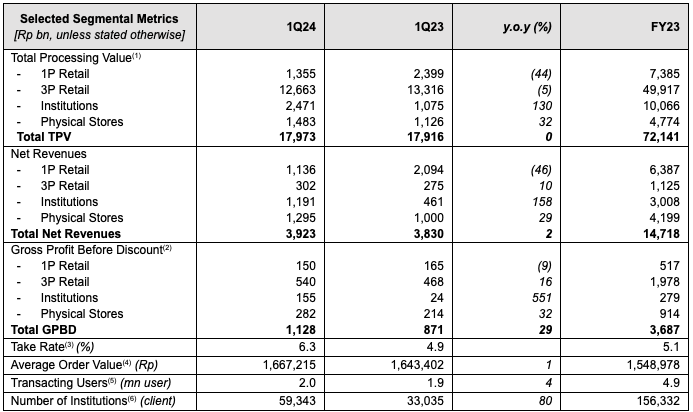

KEY OPERATIONAL HIGHLIGHTS

Source: Company’s Information

(1) Total Processing Value (“TPV”) is total value of paid and delivered purchases for products and services in the relevant year/period

(2) Gross Profit Before Discount (“GPBD”) is gross profit earned from direct sales after adding back discount and subsidies during the relevant year/period

(3) Take Rate is defined as GPBD divided by TPV in the relevant year/period

(4) Average Order Value (“AOV”) is TPV on Blibli and tiket.com platforms divided by the total number of orders for paid purchases facilitated by these platforms, each for the relevant year/period

(5) Transacting Users is the number of unique users that have completed at least one paid transaction on Blibli and/or tiket.com platforms during the relevant year/period

(6) Institution Clients includes both from public and private sectors

SEGMENTAL OVERVIEW

Below is an overview from each of the Company’s business segments during the first quarter of 2024 (1Q24) compared to the first quarter of 2023 (1Q23) period.

1P Retail

1P Retail segment undertakes the Company’s business through its B2C online commerce platform for first-party (1P) products and services from various categories.

GPBD for this segment experienced a slight decline by 9% y.o.y from Rp165 bn in 1Q23 to Rp150 bn in 1Q24. The lower GPBD performance was mainly due to the decline of TPV and Net Revenues for this segment in 1Q24 y.o.y to Rp1,355 bn and Rp1,136 bn, respectively, as the Company continued its strategy to optimize its TPV mix for this segment throughout the period. Nevertheless, the rationalization measure taken resulted in this segment enjoying significantly higher Take Rate and Gross Margin during the period.

The construction progress of the Company’s new warehouse in Marunda, West Java, has reached ~85% as at the end of March 2024 and is projected to start operating in stages in the fourth quarter of this year. The Marunda warehouse is built on 100,000-sqm land and is prepared to support the Company’s commitment to develop smart logistics and supply chain management.

3P Retail

3P Retail segment predominantly records the Company’s platform fees generated from sales of products and services of various categories from third-party (3P) sellers through its online commerce and OTA platforms.

GPBD for this segment grew healthily by 16% y.o.y from Rp468 bn in 1Q23 to Rp540 bn in 1Q24. The improved GPBD performance was mainly driven by higher contribution from the Company’s OTA business which benefited from the Ramadhan period. In addition, the Company also started to implement adjustment of its published rate for its third-party sellers to be in line with the market starting in January this year. Overall Net Revenues for this segment still grew by 10% in 1Q24 y.o.y to Rp302 bn.

As at the end of March 2024, the Company’s OTA platform – tiket.com, had a vast product assortment offering, including 116 airline partners covering 225 countries, regions, and territories, more than 3.6 million accommodation listings, including 2.2 million alternative accommodations, more than 77,700 activities and attractions as well as more than 3,500 events across Indonesia.

Institutions

Institutions segment includes the Company’s business through its B2B and B2G platforms for 1P and 3P products and services serving private and public-sector institutions across Indonesia.

GPBD for this segment grew significantly by 551% y.o.y from Rp24 bn in 1Q23 to Rp155 bn in 1Q24, mainly contributed by the strong sales performance of the consumer electronics products. Throughout the period, this segment also managed to improve the quality of its institutional clients reflected by higher spending per institutional client, resulting in significantly higher TPV, which increased by 130% y.o.y to Rp2,471 bn in 1Q24 and higher Net Revenues, which grew by 158% y.o.y to Rp1,191 bn in 1Q24.

As at the end of March 2024, the Company’s Institutional segment has managed to serve and fulfill orders from over 59,000 institutional clients. The monetization rate for this segment has also improved, reflected by higher Net Revenues as percentage of TPV from 43% in 1Q23 to 48% in 1Q24, indicated higher trusts from the institution clients towards the Company’s platforms to fulfil their corporate needs.

Physical Stores

Physical Stores segment records the Company’s business in physical consumer electronics stores collaborating with leading global consumer electronics brand principals, as well as premium grocery supermarkets chain operated by 70.6%-owned Subsidiary, PT Supra Boga Lestari Tbk (“Ranch Market”; IDX: RANC).

GPBD for this segment grew strongly by 32% y.o.y from Rp214 bn in 1Q23 to Rp282 bn in 1Q24. The improved GPBD performance was mainly driven by increased in TPV and Net Revenues for this segment during the period as the Company continued to expand its consumer electronics stores network, especially with the additional opening of new hello (Apple) and Samsung stores, as well as higher smartphones sales volume. This positive trend reflects the Company’s success in rolling out its omnichannel strategy to provide seamless customer shopping experiences both online and offline.

With the additional of 6 new consumer electronics stores during the first quarter, the Company operated a total of 172 consumer electronics stores as at the end of March 2024, which consists of 90 monobrand stores (including 70 Samsung Stores and 11 hello stores, along with the other global leading brand stores), and 82 multibrand stores (including 54 Blibli Stores and 28 Tukar Tambah stores), as well as 63 premium supermarket outlets nationwide operated by Ranch Market, to expand consumer omnichannel touchpoints.

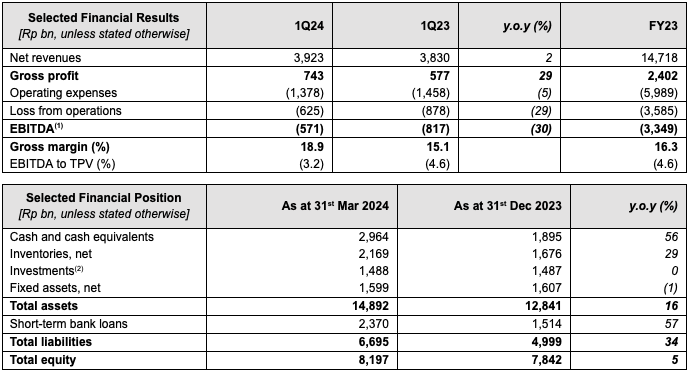

CONSOLIDATED FINANCIAL PERFORMANCES

The financial results for the periods ended 31st March 2024 and 2023 as well as the financial position as at 31st March 2024 have been prepared in accordance with Indonesian Financial Accounting Standards and are unaudited. The financial results for the periods ended 31st December 2023 as well as the financial position as at 31st December 2023 have been prepared in accordance with Indonesian Financial Accounting Standards and audited in accordance with the auditing standards established by the Indonesian Institute of Certified Public Accountants.

(1) EBITDA refers to Earnings Before Interest, Tax, Depreciation and Amortization (“EBITDA”): earnings before interest, tax, depreciation of fixed assets and amortization of intangible assets, and excludes non-recurring items, during the relevant year/period

(2) Investments refers to the Company’s investments balance in the form of shares, fund, convertible loan, and associate entities

MANAGEMENT DISCUSSION & ANALYSIS

Below are brief descriptions of the Company’s consolidated financial performances during the first quarter of 2024 (1Q24) compared to the first quarter of 2023 (1Q23) period.

Revenue & Profitability

Consolidated Net Revenues recorded 2% increase from Rp3,830 bn in 1Q23 to Rp3,923 bn in 1Q24, mainly contributed from the strong performance of the Company’s online travel agent (OTA) business on the back of Ramadhan period and strong performance in the Institutions and Physical Stores segments, partly offset by optimization of product mix across categories in the 1P Retail segment.

With the growth of Net Revenues and rationalization of TPV mix, the Company successfully recorded a much better consolidated Gross Margin from 15.1% in 1Q23 to 18.9% in 1Q24, an improvement of 390-bps y.o.y. The improved performance of the consolidated Gross Margin was supported by the expansion of consolidated Gross Profit, especially from the improved OTA business which benefited from the Ramadhan period and strong sales performance of consumer electronics products in the Institutions segment, as well as higher smartphones sales volume in the Company’s consumer electronics stores.

Throughout the first quarter, the Company also continued to improve its operational excellence which resulted in a better cost structure, reflected from lower consolidated Operating Expenses as percentage of TPV from 8.1% in 1Q23 to 7.7% in 1Q24, mainly driven by the lower advertising & marketing expenses as percentage of TPV during 1Q24 y.o.y to 0.8%, and lower warehouse, packaging and delivery expenses as percentage of TPV in 1Q24 y.o.y to 0.2%. Meanwhile, general and administrative expenses as percentage of TPV during 1Q24 y.o.y recorded slightly higher to 5.1% mainly due to store rental and employees’ costs as the Company continued expanding its physical presence as part of its omnichannel strategy.

The improvement in overall cost structure was achieved as a result of the Company’s continuous channels optimizations within the ecosystem to grow the TPV at a lower marketing cost. As a result of these cost efficiency measures, consolidated EBITDA performance as percentage of TPV also recorded an improvement from -4.6% in 1Q23 to -3.2% in 1Q24, improved by 140-bps y.o.y.

Improving Operating Cash Flows

Net cash used in operating activities was Rp716 bn in 1Q24, improved significantly from Rp1,410 bn in 1Q23. Improving margin, lower operating expenses and better working capital management contributed to better operating cash flow. It helped to improve the Company’s cash and cash equivalents position as at 31st March 2024 to Rp2,964 bn.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG)

As a pioneer of an integrated omnichannel commerce and lifestyle ecosystem, the Company continuously strengthens its ESG performance by optimizing synergies within the ecosystem and fostering collaboration among stakeholders to encourage real actions to achieve sustainable growth.

The Company realized its sustainability commitment by introducing “Blibli Tiket Action” as an umbrella program to support its ESG aspects, with the outcomes including:

- Increased the use of environmentally friendly packaging, such as FSC-certified cardboard, recycled material packaging, and paper-based packaging;

- Reduced emissions through external efficiency in operational activities and stakeholder engagement programs, such as tree planting and organizing the “Langkah Membumi Festival” event;

- Optimized internal waste management to increase the proportion of reused and recycled waste;

- Improved synergy and collaboration by providing training and development programs to create future-ready employees, by adhering to inclusivity, equality, and non-discrimination principles in every activity with employees and ensuring their health and safety;

- Empowered local economy by promoting local seller partners and MSMEs through the “Pejuang Lokal” program, and empowering tourism villages through the “Jagoan Pariwisata” program, in collaboration with the Indonesian Ministry of Tourism and Creative Economy; and

- Strengthened corporate governance practice by prioritizing trusted and robust data governance, including information security and customer privacy data based on regulations, policies, and ISO 27001:2013 certification standards.

BUSINESS PROSPECTS

Economic conditions and consumer market will likely remain volatile. However, the company will remain steadfast in its core strategy to build the commerce ecosystem of choice for consumers and institutions. Going forward, the Company will further innovate its potential synergies to further enhance the number of transacting users and spending quality of the customers organically within the ecosystem. In addition, the Company will continue to implement its omnichannel strategy by keep expanding its consumer touchpoints, partnering with global leading brand principals, in order to offer a seamless customers’ experience and journey when doing transactions in any of the Company’s platform within the ecosystem. These will enable the Company to drive the growth of its business and maintain its favorable trend towards profitability.