30th March 2024 | Jakarta, Indonesia

PT Global Digital Niaga Tbk (the “Company”; IDX: BELI), a pioneer and leading omnichannel commerce and lifestyle ecosystem in Indonesia focusing on serving digitally connected retail and institutions consumers, today announced its full year earnings results for the year 2023.

KEY HIGHLIGHTS

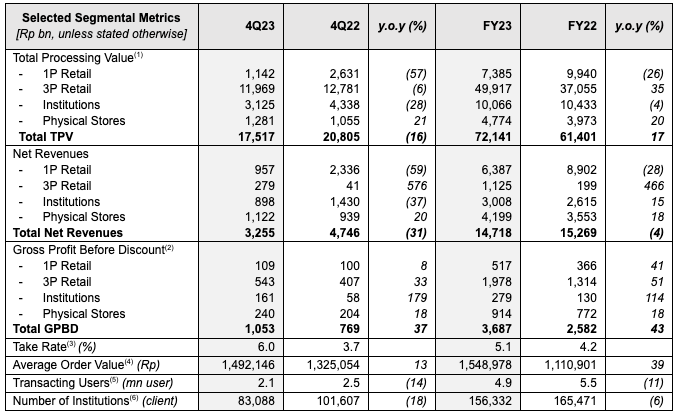

- TPV grew by 17% in FY23 y.o.y to Rp72,141 bn, mainly driven by the increased performance in the online travel agent (“OTA”) business of 3P Retail segment and improved performances of consumer electronics stores of the Physical Stores segment.

- GPBD in all business segments improved across the board in FY23 y.o.y, which was mainly supported by optimization of product categories mix as well as discount and promotion in the 1P Retail segment, and strong sales performance of consumer electronics in the Institutions segment. As a result, combined Take Rate also increased from 4.2% in FY22 to 5.1% in FY23.

- Consolidated Gross Margin recorded a strong growth from 8.0% in FY22 to 16.3% in FY23, an increase of 830-bps y.o.y, mainly contributed from the Gross Profit expansion in all business segments.

- Cost structure continued to improve, reflected by the lower consolidated Operating Expenses as percentage of TPV from 10.2% in FY22 to 8.3% in FY23. This resulted in an improved performance of consolidated EBITDA as percentage of TPV by 310-bps, from -7.8% in FY22 to -4.6% in FY23.

- Currently, the Company is building a new warehouse in Marunda, of which construction progress has reached ~60% as at the end of 2023 and is projected to start operating in stages by 2024.

- The Company’s unified loyalty program – Blibli Tiket Rewards, has been integrated to all platforms within the Blibli Tiket ecosystem (including Blibli, tiket.com, Ranch Market and consumer electronics stores). This enhanced cross-selling within the ecosystem, which ultimately provided more efficient growth by reducing advertising and marketing expenses and lowering customer acquisition costs.

- The Company continued amplifying omnichannel strategy with an additional of 40 consumer electronic stores throughout 2023, which brings a total of 166 consumer electronics stores operated by the Company, as well as 65 premium supermarkets outlets as of the end of 2023.

MANAGEMENT STATEMENT(S)

Kusumo Martanto – CEO & Co-Founder

“Reflecting on 2023, our strategic agenda was comprehensive, targeting the expansion of our product assortment, the enhancement of value-add services, the advancement of technology, and the amplification of ecosystem synergies. Central to our profitability strategy was the optimization of our product mix, prioritizing higher-margin products and aligning third-party seller rates with our profitability roadmap.

Our commitment to operational efficiency was unwavering, with data-driven optimizations in advertising spend and a push for automation across our processes. We further enhanced the Blibli Tiket Rewards program, including expanding the earn and redemption universe to offline retail locations (e.g hello and Blibli stores), driving traffic and offering unprecedented convenience and benefits to consumers. This marks a significant stride in enriching the customer experience while encouraging cross-selling, thereby optimizing customer acquisition costs.

Our execution on our omnichannel strategy was not just a differentiator in the industry but a continuation of our long-standing commitment to seamlessly integrating the online and offline worlds through technological innovation. We enhanced our service offerings by extending existing services, notably achieving full integration of Ranch Market retail network into our Click & Collect service; and releasing new augmented reality (AR) technology in certain product categories. These advancements served to combine digital convenience with the tangibility of physical interactions – a hallmark of our strategy – offering our customers a uniquely delightful shopping experience.

2023 was also a year where efficiency became a linchpin in our operations. We harnessed data to optimize advertising spend, embraced automation and technology to streamline operations, and innovated media utilization to bolster our marketing’s effectiveness and efficiency.

Our B2C approach, strongly supported by collaborations with globally recognized brands, reaffirmed their confidence in our vision and our leadership in omnichannel retail innovation. By leveraging advanced analytics for personalized engagements, we have not only met but exceeded evolving consumer expectations, solidifying our foundation for sustainable growth.

Looking back, the execution of these strategies throughout 2023 has significantly elevated shopping experience of our retail customers and institutional clients, driving the Company’s business and profitability performance, as well as delivering added value to all stakeholders.”

Ronald Winardi – CFO

“Throughout 2023, we focused on improving our profitability performance. This was done by rationalizing our product categories mix across 1P Retail segment and adjusting fees of our marketplace business, which resulted in significant improvement of our Gross Profit generation and healthier Gross Margin. In addition, our continuous cost efficiency steps were implemented, especially in the advertising and marketing costs, which has further reduced our loss. We are confident this positive trend will continue in 2024.”

KEY OPERATIONAL HIGHLIGHTS

Source: Company’s Information

(1) Total Processing Value (“TPV”) is total value of paid and delivered purchases for products and services in the relevant year/period

(2) Gross Profit Before Discount (“GPBD”) is gross profit earned from direct sales after adding back discount and subsidies during the relevant year/period

(3) Take Rate is defined as GPBD divided by TPV in the relevant year/period

(4) Average Order Value (“AOV”) is TPV on Blibli and tiket.com platforms divided by the total number of orders for paid purchases facilitated by these platforms, each for the relevant year/period

(5) Transacting Users is the number of unique users that have completed at least one paid transaction on Blibli and/or tiket.com platforms during the relevant year/period

(6) Institution Clients includes both from public and private sectors

SEGMENTAL OVERVIEW

Below is an overview from each of the Company’s business segments during the fourth quarter of 2023 (4Q23) compared to the fourth quarter of 2022 (4Q22) period, and the full year 2023 (FY23) compared to the full year 2022 (FY22).

1P Retail

1P Retail segment undertakes the Company’s business through its B2C online commerce platform for first-party (1P) products and services from various categories.

GPBD for this segment improved healthily by 8% in 4Q23 y.o.y to Rp109 bn and by 41% in FY23 y.o.y to Rp517 bn. The improved GPBD performance was mainly driven by the Company’s strategy to optimize its TPV mix for this segment throughout the year by putting more focus on the more profitable products selection across categories, especially on the consumer electronics and consumer goods. Nevertheless, the rationalization measure taken led to lower TPV and Net Revenues for this segment in FY23 y.o.y to Rp7,385 bn and Rp6,387 bn, respectively.

The Company has developed a vast network of fulfillment and logistics infrastructure. Currently, the Company is building a new warehouse in Marunda, West Java, which construction progress has reached ~60% as at the end of 2023 and is projected to start operating in stages by 2024. Developed with a green building concept and equipped with automation, Marunda warehouse is prepared to support the Company’s commitment to develop smart logistics and supply chain management. This Marunda warehouse will be the Company’s largest warehouse and will complement the existing 130,000-sqm of the current 15 warehouses.

3P Retail

3P Retail segment predominantly records the Company’s platform fees generated from sales of products and services of various categories from third-party (3P) sellers through its online commerce and OTA platforms.

GPBD for this segment grew strongly by 33% in 4Q23 y.o.y to Rp543 bn and by 51% in FY23 y.o.y to Rp1,978 bn. The improved GPBD performance was mainly driven by the higher contribution from the Company’s OTA business which benefited from the fully recovered travel and lifestyle sector post the pandemic, as well as increased contribution from the digital products & others category. Overall TPV for this segment grew by 35% in FY23 y.o.y to Rp49,917 bn, despite experiencing a slight decline in 4Q23 y.o.y as the Company decided to be more rational on the advertising and promotion spending approaching year end. However, Net Revenues for this segment still grew very strongly by 576% and 466% in 4Q23 and FY23 y.o.y to Rp279 bn and Rp1,125 bn, respectively.

As at the end of 2023, the Company’s OTA platform – tiket.com, had a vast product assortment offering, including 114 airline partners covering 225 countries, regions, and territories, more than 3.6 million accommodation listings, including 2.2 million alternative accommodations, more than 77,600 activities and attractions as well as more than 3,400 events across Indonesia.

Institutions

Institutions segment includes the Company’s business through its B2B and B2G platforms for 1P and 3P products and services serving private and public-sector institutions across Indonesia.

GPBD for this segment improved significantly by 179% in 4Q23 y.o.y to Rp161 bn and by 114% in FY23 y.o.y to Rp279 bn, mainly contributed by the strong sales performance of consumer electronics category. Throughout 2023, this segment also managed to improve the quality of its institutional clients reflected by higher spending per institutional client, which resulted in higher Net Revenues by 15% in FY23 y.o.y to Rp3,008 bn. However, overall TPV for this segment recorded a slight decline of 4% in FY23 y.o.y to Rp10,066 bn as the overall institutional demand softened approaching the election year.

As at the end of 2023, the Company’s Institutional segment has managed to serve and fulfill orders from over 156,000 institutional clients. The monetization rate for this segment has also improved, reflected by higher Net Revenues as percentage to TPV from 25% in FY22 to 30% in FY23, indicated higher trusts from the institution clients towards the Company’s platform to fulfil their corporation needs.

Physical Stores

Physical Stores segment records the Company’s business in consumer electronics stores collaborating with leading global consumer electronics principals, as well as premium grocery supermarkets chain operated by 70.6%-owned Subsidiary, PT Supra Boga Lestari Tbk (“Ranch Market”; IDX: RANC).

GPBD for this segment grew by 18% in both 4Q23 and FY23 y.o.y to Rp240 bn and Rp914 bn, respectively. The improved GPBD performance was mainly driven by increased TPV and Net Revenues for this segment in both 4Q23 and FY23 y.o.y as the Company kept expanding its consumer electronics stores, especially with the additional opening of new hello (Apple) and Samsung stores. This positive trend reflects the Company’s success in rolling out its omnichannel strategy to provide seamless customer experiences both online and offline.

Throughout 2023, there were a total of 40 additional consumer electronics stores opened to boost the Company’s omnichannel strategy. As at the end of 2023, the Company operated a total of 166 consumer electronics stores, which consists of 87 monobrand stores (including 68 Samsung Stores and 10 hello stores, along with the other global leading brand stores), and 79 multibrand stores (including 29 Blibli Stores and 50 Tukar Tambah stores), as well as 65 premium supermarket outlets nationwide operated by Ranch Market.

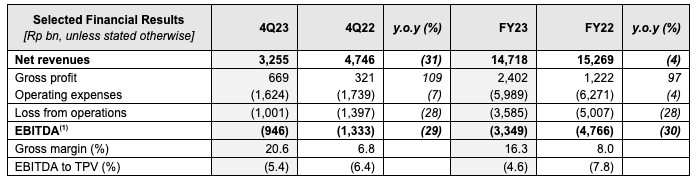

CONSOLIDATED FINANCIAL PERFORMANCES

The financial results for the periods ended 31st December 2023 and 2022 as well as the financial position as at 31st December 2023 and 2022 have been prepared in accordance with Indonesian Financial Accounting Standards and audited in accordance with the auditing standards established by the Indonesian Institute of Certified Public Accountants.

(1) EBITDA refers to Earnings Before Interest, Tax, Depreciation and Amortization (“EBITDA”): earnings before interest, tax, depreciation of fixed assets and amortization of intangible assets, and excludes non-recurring items, during the relevant year/period

(2) Investments refers to the Company’s investments balance in the form of shares, fund, convertible loan, and associate entities

MANAGEMENT DISCUSSION & ANALYSIS

Below are brief descriptions of the Company’s consolidated financial performances during the fourth quarter of 2023 (4Q23) compared to the fourth quarter of 2022 (4Q22) period, and the full year 2023 (FY23) compared to the full year 2022 (FY22).

Revenue & Profitability

Consolidated Net Revenues recorded 4% decrease from Rp15,269 bn in FY22 to Rp14,718 bn in FY23, mainly due to the Company’s strategy to optimize its TPV mix throughout the year by putting more focus on the more profitable products selection across categories in 1P Retail segment, partly offset by strong performance of the Company’s online travel agent (OTA) business and stronger contribution from the digital products & others category, as well as increased performance in the Institutions segment.

Despite lower Net Revenues, the Company still managed to achieve organic growth within the ecosystem, shown by higher average order value by 39% from Rp1,110,901 in FY22 to Rp1,548,978 in FY23. Furthermore, the Company also successfully improved its quality of retail users and institutional clients, shown by increased spending per user from Rp8.6 mn in FY22 to Rp11.7 mn in FY23, and higher spending per institutional client from Rp63.0 mn per client in FY22 to Rp64.4 mn per client in FY23.

Consolidated Gross Margin also recorded an increase of 830-bps, from 8.0% in FY22 to 16.3% in FY23. The improved performance of the Gross Margin was supported by Gross Profit expansion from all business segments, especially through an optimization of product categories mix as well as discount and promotion in 1P Retail segment, much improved OTA business which benefited from the fully recovered travel and lifestyle sector post the pandemic, and strong sales performance of consumer electronics in the Institutions segment.

Throughout 2023, the Company also continued to improve its operational excellence which resulted in a better cost structure, reflected from lower consolidated Operating Expenses as percentage to TPV from 10.2% in FY22 to 8.3% in FY23, mainly driven by the lower advertising & marketing expenses as percentage to TPV during FY23 y.o.y to 1.4%, and lower warehouse, packaging and delivery expenses as percentage to TPV in FY23 y.o.y to 0.3%. Meanwhile, general and administrative expenses as percentage to TPV during FY23 y.o.y also recorded lower to 5.1%. The improvement in cost structure was achieved as a result of the Company’s continuous channels optimizations within ecosystem to grow the TPV at a lower marketing cost, and realignment of some of the human resources to improve productivity. As a result of these cost efficiency measures, consolidated EBITDA performance as percentage to TPV also improved by 310-bps in FY23 y.o.y to -4.6%.

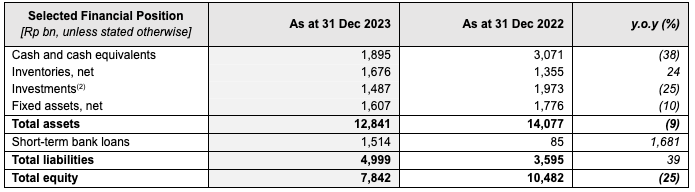

Liquidity & Cash Position

Net cash used in operating activities was Rp3,788 bn in FY23, primarily represents cash payment to suppliers of Rp39,119 bn and cash payment for operating expenses of Rp3,461 bn, partly offset by cash receipts from customers amounted Rp40,867 bn. Net cash provided by investing activities was Rp462 bn in FY23, mainly contributed from the Rp538 bn of cash proceeds from sale of investment. Net cash provided by financing activities was Rp2,150 bn in FY23, primarily representing cash proceeds from short-term bank loans of Rp8,003 bn, partly offset by cash payment of short-term bank loans of Rp6,574 bn. Therefore, the Company’s cash and cash equivalents position as at 31st December 2023 was at Rp1,895 bn compared to Rp3,071 bn as at 31st December 2022.

BUSINESS PROSPECTS

Going forward, the Company will focus on developing and amplifying the omnichannel strategy of the Blibli Tiket ecosystem through further expansion of physical stores partnering with leading global brand principals. By having physical presence, it enables our consumers to have a more seamless shopping experience within the Company’s ecosystem, both online and offline.

Further, the Company’s omnichannel integrated and unified loyalty program – Blibli Tiket Rewards, has been integrated to all Company’s platforms of Blibli Tiket ecosystem, which enables our customers to earn and spend the same loyalty points seamlessly within the Company’s e-commerce and OTA platforms, consumer electronics stores and premium groceries outlets nationwide. This is expected to enhance cross-selling within the ecosystem, which ultimately provides more efficient growth by reducing advertising and marketing expenses, and lowering customer acquisition costs.

By focusing on cost leadership strategy, margin optimization, and ecosystem operational excellence, the Company believes it can grow its business more sustainably and at the same time keep maintaining the positive trend of profitability performance.