28th April 2023 | Jakarta, Indonesia

PT Global Digital Niaga Tbk (the “Company”; IDX: BELI), a pioneer omnichannel commerce and lifestyle ecosystem in Indonesia focusing on serving digitally connected retail and institutions consumers, today announced its first quarter earnings results for the year 2023.

KEY HIGHLIGHTS

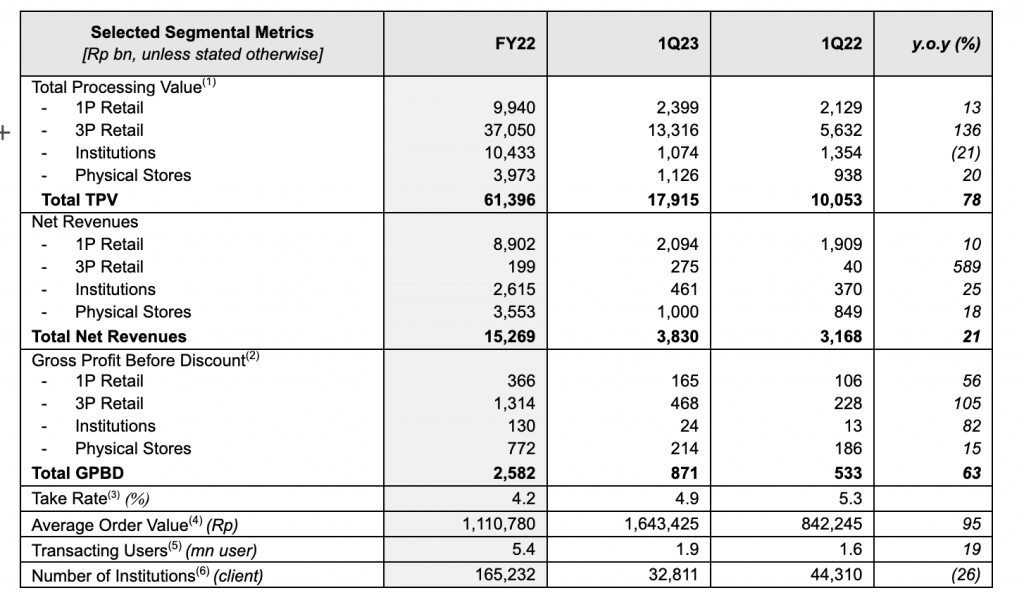

- The Company recorded solid TPV growth of 78% from Rp10,053 bn in 1Q22 to Rp17,915 bn in 1Q23, driven by the increased performance in most of the business segments, especially with the strong recovery in online travel industry in Indonesia as well as increased demand of digital products & others category. Both positively impacted 3P Retail TPV, which grew by 136% in 1Q23 y.o.y.

- Consolidated net revenues grew by 21% from Rp3,168 bn in 1Q22 to Rp3,830 bn in 1Q23, while consolidated gross margin also recorded higher from 9.5% in 1Q22 to 15.1% in 1Q23, an improvement of 560-bps y.o.y, mainly supported by higher GPBD across all business segments.

- Improved cost structure with consolidated operating expenses as percentage to TPV declined from 13.4% in 1Q22 to 8.1% in 1Q23, resulting in the improvement of consolidated EBITDA as percentage to TPV by 510-bps y.o.y, from -9.7% in 1Q22 to -4.6% in 1Q23.

- Adjusted published rate for 3P sellers which has been effective starting in March 2023. The adjusted rate is expected to enhance the Company’s margin optimization strategy going forward.

- Launched “blibli tiket rewards”, a unified loyalty program for all users in both Blibli and tiket.com platforms, which will enable the Company to have single view of its customers within the ecosystem and to create more personalized and targeted product/service offerings.

- Continued amplifying omnichannel strategy through the opening of 19 new multibrand stores during the period, which brings a total of 142 consumer electronics stores (including monobrand and multibrand store) operated by the Company and 70 premium supermarkets outlets operated by the Company’s subsidiary – PT Supra Boga Lestari Tbk (“Ranch Market”; IDX: RANC).

MANAGEMENT STATEMENT(S)

Kusumo Martanto – CEO & Co-Founder

“Notwithstanding not immune to the market climate in which our businesses operate, we started the year 2023 with optimism to tackle all the challenges ahead and having full confidence to accomplish even better growth sustainably, and ultimately getting us closer to profitability.

During the first quarter, we continued to focus on amplifying our omnichannel strategy by expanding more physical stores in both consumer electronics as well as groceries, while the launching of “blibli tiket rewards” as a unified loyalty program is expected to strengthen our ecosystem play systematically throughout the year. In the meantime, our endless means on the cost efficiencies measures have shown greater results, reflected in the considerable improvement of our operating leverages; all of which have positively impacted on our financial performance.

The Company, including all our employees, are well aware that the strategies set out can only be accomplished with unwavering focus and determination from each individual who work as a team toward the same goal in pushing for healthier business growth and profitability, and we will ensure every step we take is for the best interests of our stakeholders.”

Hendry – CFO & Co-Founder

“Our positive financial performances trend in 2022 carried on to the first quarter of this year, predominantly supported by the solid growth of our TPV in most of business segments, especially in the 3P Retail business which benefited from the recovery of online travel industry in Indonesia. Our decision to make some adjustments of our third-party sellers in our e-commerce platform is expected to further boost our margins even further, along with other margin optimization strategies going forward, including on focusing high margin product categories, taking larger value chain margin for 1P products, as well as expanding into lucrative white spaces including private label products category.

We also managed to improve our cost structure even better, notably the decline in our marketing and advertising as well as general administrative expenses ratio compared to our TPV; both contributed to the improvement of our consolidated EBITDA performance during the period. Meanwhile, our cash position along with the available credit facilities should be sufficient to enable us carrying out all of our business strategies to grow sustainably and strengthening our path to profitability.”

KEY OPERATIONAL HIGHLIGHT

Source: Company’s Information

- Total Processing Value (“TPV”) is total value of paid and delivered purchases for products and services in the relevant year/period

- Gross Profit Before Discount (“GPBD”) is gross profit earned from direct sales after adding back discount and subsidies during the relevant year/period

- Take Rate is defined as GPBD divided by TPV in the relevant year/period

- Average Order Value (“AOV”) is TPV on Blibli and tiket.com platforms divided by the total number of orders for paid purchases facilitated by these platforms, each for the relevant year/period

- Transacting Users (“YTU”) is the number of unique users that have completed at least one paid transaction on Blibli and/or tiket.com platforms during the relevant year/period

- Institution Clients includes both from public and private sectors

BUSINESS OVERVIEW

Below is an overview from each business segment of the Company during the first quarter of 2023 (1Q23) compared to the first quarter of 2022 (1Q22) period:

1P Retail

1P Retail segment undertakes the Company’s business through its B2C online platform for first-party (1P) products and services from various categories.

Overall TPV for this segment grew by 13% from Rp2,129 bn in 1Q22 to Rp2,399 bn in 1Q23, mainly driven by growing demand in the consumer electronics and lifestyle categories. This resulted in an increase of net revenues for this segment by 10% from Rp1,909 bn in 1Q22 to Rp2,094 bn in 1Q23. In addition, GPBD also grew by 56% in 1Q23 y.o.y, mainly due to the changes in the product category mix.

In January 2023, the Company opened a new warehouse with an area of 480 sqm located in Lampung. The addition of this new warehouse brings to a total of 16 warehouses owned by the Company to support its logistics and fulfillment capabilities, with a total warehouse area approximately ~130,500 sqm.

3P Retail

3P Retail segment predominantly records the Company’s platform fees generated from sales of products and services of various categories from third-party (3P) sellers through its e-commerce and online travel agent (OTA) platforms.

Overall TPV for this segment grew strongly by 136% from Rp5,632 bn in 1Q22 to Rp13,316 bn in 1Q23, predominantly contributed by the much-improved performance in the lifestyle category on the back of strong online travel recovery as a result of the re-opening of pandemic restrictions in Indonesia which only started in second quarter of 2022, as well as much improved performance from the digital products & others category. This resulted in a significant increase of net revenues for this segment by 589% from Rp40 bn in 1Q22 to Rp275 bn in 1Q23. GPBD also increased by 105% in 1Q23 y.o.y, in line with the better overall performance of this segment.

During the first quarter of 2023, the Company has taken a decision to make some adjustments on its third- party sellers (3P sellers) published rate, across various categories. The adjustment will allow the Company to have more flexibility to innovate and provide more added-value services to its 3P sellers and is expected to further boost the overall margin optimization strategy going forward.

As at the end of March 2023, the Company’s OTA platform had a vast product assortment offering, including

103 airline partners covering more than 220 countries, regions, and territories, more than 3.6 million accommodation listings, including 2.2 million alternative accommodations, more than 50,300 activities and attractions as well as more than 2,700 events across Indonesia.

Institutions

Institutions segment includes the Company’s business through its B2B platform for 1P and 3P products and services for private and public-sector institutions across Indonesia.

During the period, Institutions business contributed Rp1,074 bn of the total TPV, Rp461 bn of consolidated net revenues and Rp24 bn of total GPBD. Despite a 21% y.o.y decline of TPV, this segment recorded growth in net revenues and GPBD by 25% and 82% in 1Q23 y.o.y, respectively. The monetization rate for this segment also improved, reflected by net revenues as percentage to TPV increased from 27% in 1Q22 to 43% in 1Q23.

Physical Stores

Physical Stores segment records the Company’s business in consumer electronics physical stores partnering with global leading brands partners as well as premium grocery supermarkets chain operated by 70.56%- owned Subsidiary, PT Supra Boga Lestari Tbk (“Ranch Market”; IDX: RANC).

Overall TPV for this segment grew by 20% from Rp938 bn in 1Q22 to Rp1,126 bn 1Q23, mainly driven by improved performances from both consumer electronics stores and supermarket outlets during the period. This resulted in an increase in net revenues for this segment by 18% from Rp849 bn in 1Q22 to Rp1,000 bn 1Q23. Meanwhile, GPBD also increased by 15% in 1Q23 y.o.y, as some of the Company’s new consumer electronics stores and supermarket outlets were starting to ramp up during the period.

As at the end of March 2023, the Company operates a total of 142 consumer electronics stores, which consists of 76 monobrand stores, such as Samsung Experience Store and hello (Apple monobrand store), 66 multibrand stores, such as Blibli Store and Tukar Tambah (trade-in store), as well as 70 premium supermarket outlets nationwide.

CONSOLIDATED FINANCIAL PERFORMANCES

The financial results for the periods ended 31st March 2023 and 2022 as well as the financial position as at 31st March 2023 have been prepared in accordance with Indonesian Financial Accounting Standards and are unaudited. The financial results for the year ended 31st December 2022 and the financial position as at 31st December 2022 have been prepared in accordance with Indonesian Financial Accounting Standards and audited in accordance with the auditing standards established by the Indonesian Institute of Certified Public Accountants.

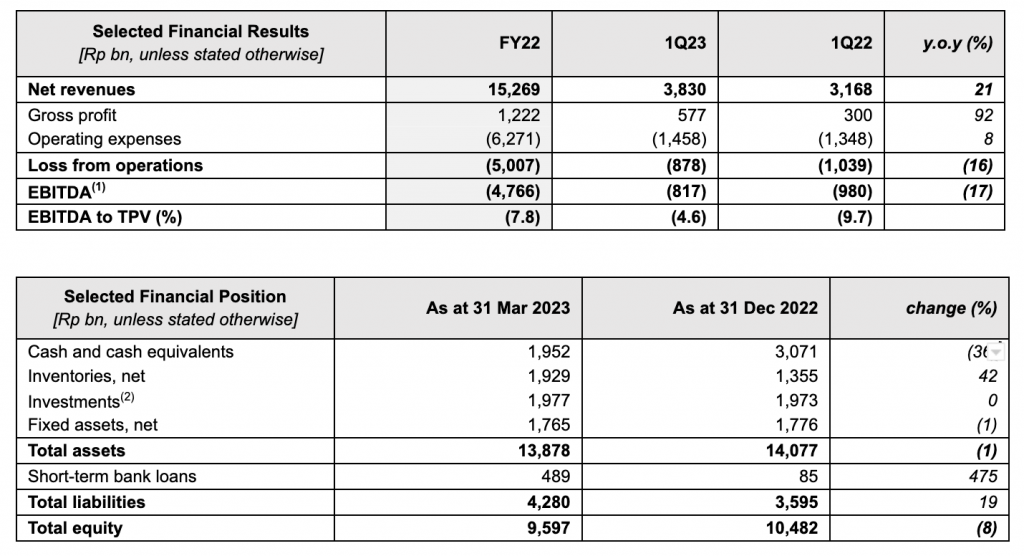

- EBITDA refers to Earnings Before Interest, Tax, Depreciation and Amortization (“EBITDA”): earnings before interest, tax, depreciation of fixed assets and amortization of intangible assets, and excludes non-recurring items, during the relevant year/period

- Investments refers to the Company’s investments balance in the form of shares, fund, convertible loan, and associate entities

MANAGEMENT DISCUSSION & ANALYSIS

Below are brief descriptions of the Company’s consolidated financial performances during the first quarter of 2023 (1Q23) compared to the first quarter of 2022 (1Q22) period:

Revenue & Profitability

Consolidated net revenues recorded 21% increase from Rp3,168 bn in 1Q22 to Rp3,830 bn in 1Q23 mainly driven by growth in 3P Retail segment, which benefited from much-improved performance in the lifestyle category on the back of strong online travel recovery as a result of the re-opening of pandemic restrictions in Indonesia which only started in second quarter of 2022, as well as increased demand on the digital products & others category.

The TPV and net revenues growth was supported by organic growth, as shown by the increase of transacting users from 1.6 million users in 1Q22 to 1.9 million users in 1Q23, and higher average order value by 95% from Rp842,245 in 1Q22 to Rp1,643,425 in 1Q23, as well as improved quality of users shown by increased spending per user in retail business and spending per client in institutions business, by 71% and 7% in 1Q23 y.o.y, respectively. This resulted in a better consolidated gross margin recorded by the Company from 9.5% in 1Q22 to 15.1% in 1Q23.

The Company also successfully improved its operational performances on the back of better cost structure, shown from lower advertising & marketing expenses as percentage to TPV from 3.1% in 1Q22 to 1.4% in 1Q23, as well as lower general & administrative expenses as percentage to TPV from 7.8% in 1Q22 to 5.0% in 1Q23. This resulted in an improved consolidated EBITDA performance as percentage to TPV from -9.7% in 1Q22 to -4.6% in 1Q23.

Liquidity & Cash Position

Net cash used in operating activities was Rp1,410 bn in 1Q23, primarily represents cash payment to suppliers of Rp9,919 bn and cash payment for operational expenses of Rp1,016 bn, partly off set by cash receipts from customers amounted Rp9,994 bn. Net cash used in investing activities was Rp51 bn in 1Q23, mainly represents acquisition of fixed assets of Rp36 bn. Net cash provided from financing activities was Rp341 bn in 1Q23, primarily represents receipts of short-term bank loans of Rp659 bn, partly off set by cash payment of short-term bank loans of Rp255 bn. Therefore, the Company’s cash and cash equivalents position as at 31st March 2023 was at Rp1,952 bn compared to Rp3,071 bn as at 31st December 2022.

BUSINESS PROSPECTS

Looking at the first quarter results, the Company is confident to record stronger business performances across all business segments even further in 2023, supported with the continued implementation of margin optimization strategies, by driving its focuses on what the customer wants, which products selections to offer, and enhance the key strengths that differentiate the Company from its peers in the respective industry. On the cost leadership strategy, the Company will continue to further implement cost efficiency programs across all businesses and departments, including to optimize advertising and marketing expenses and IT infrastructure costs. Meanwhile, more innovation of new potential synergies within the ecosystem will be roll out soon in order to further enhance transacting users and spending quality on each of the Company’s platforms.

– End –

Disclaimer

This document (“Publication”) has been prepared by PT Global Digital Niaga Tbk. (the “Company”) for information purposes only and does not constitute a recommendation or an offer to buy regarding any securities of the Company. The information contained in this Publication has not been independently verified, approved, and/or endorsed and is subject to material changes. The information and opinions in this Publication are of a preliminary nature, subject to change without notice, its accuracy is not guaranteed, and it may not contain all material information concerning the Company. None of the Company, its management, its advisors nor any of their respective affiliates, shareholders, directors, employees, agents, and/or advisers (together, “the Group”) assumes any responsibility or liability whatsoever (in negligence or otherwise) for, the accuracy or completeness of, or any errors or omissions in, any information contained herein nor for any loss howsoever arising from any use of information within.

The information contained in this Publication should be considered in the context of the circumstances prevailing at the time published and is subject to change without notice and/or will not be updated to reflect material developments that may occur after the date hereof. The statements contained in this Publication speak only as at the date as of which they are made, and the Company expressly disclaims any obligation or undertaking to supplement, amend or disseminate any updates or revisions to any statements contained herein to reflect any change in events, conditions and/or circumstances on which any such statements are based. This Publication may not be all-inclusive and may not contain all the information that a recipient or reader may consider material. By preparing this Publication, the Group does not undertake any obligation to provide any recipient or readers with access to any additional information or to update this Publication or any additional information or to correct any inaccuracies in any such information which may become apparent. The Group shall not make any express or implied representation and/or warranty as to the accuracy and completeness of the information contained herein and none of them shall accept any responsibility or liability (including any third-party liability) for any loss or damage, whether arising from any error or omission in compiling such information or as a result of any party’s reliance or use of such information.

Forward-looking Statement

Certain statements in this Publication constitute “forward-looking statements” and information with respect to the future financial condition, results of operations and certain plans and/or objects of management of the Company and the Group. Forward-looking statements may include words or phrases such as the Company or any of its business components, or its management “believes”, “expects”, “anticipates”, “intends”, “plans”, “foresees”, or other words or phrases of similar import. Similarly, statements that describe the Company’s objectives, plans or goals both for itself and for any of its business components also are forward-looking statements. Such forward-looking statements are made based on management’s current expectations or beliefs as well as assumptions made by, and information currently available to, management. A such forward-looking statement is not a guarantee of future performance and involves known and unknown risks, uncertainties, and other factors (including the risks and uncertainties in the Company’s financial statements and Management Discussion & Analysis available on the Company’s website), that may cause actual results, performance, or achievements to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statement. The Company disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, events or otherwise. Readers are cautioned not to put undue reliance on such a forward-looking statement.

Non-IFAS Financial Measures

To supplement the Company’s consolidated financial statements, which are prepared and presented in accordance with statement of financial accounting standards in Indonesia (“IFAS”), the Company provides certain non-IFAS financial measures, including but not limited to, “EBITDA”, “GPBD” and/or “Take Rate”, which should be considered in addition to results prepared in accordance with IFAS but not in isolation or as substitutes for IFAS results. Such non-IFAS financial measures may differ from similarly titled measures used by other companies and are presented to enhance recipients or readers the overall understanding of the Company’s financial performances and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with IFAS. In addition, this Publication contains certain operating metrics including , “TPV”, “YTU”, “AOV” and/or “MAU”, used by the Company to evaluate its business. Such operating metrics may differ from estimates published by third parties or from similarly titled metrics used by other companies due to differences in methodology and assumptions.

About the Company

Established in 2010, PT Global Digital Niaga Tbk (the “Company”) is a pioneer omnichannel commerce and lifestyle ecosystem in Indonesia, focusing on serving digitally connected retail and institutions consumers. The Company’s commerce platform – Blibli, integrates online consumer shopping experience through its e-commerce platform and offline shopping experience through operating physical stores for some leading global brand partners. In addition, Blibli also collaborating with more than 30,800 stores adopting omnichannel features, namely Blibli Instore and Click & Collect, supported by its own fulfillment infrastructure, including developed nationwide warehouses and logistics networks as well as enhance the first-party (1PL) last-mile delivery capabilities through BES Paket and cooperating with numerous third-party (3PL) logistics partners. Blibli is ranked no.1 in the B2C omnichannel 1P consumer electronics and fresh products categories by Frost & Sullivan and has award-winning 24/7 customer service.

In 2017, the Company acquired PT Global Tiket Network (tiket.com) to expand its offerings to include traveling, accommodations, and lifestyle experiences. Further in 2021, the Company’s omnichannel ecosystem was complemented by adding fresh foods and groceries offering through the acquisition of PT Supra Boga Lestari Tbk (“Ranch Market”; IDX: RANC) – a company that manages premium supermarkets outlets such as Ranch Market and Farmers Market.

The Company has a unified omnichannel ecosystem called Blibli Tiket, to strengthen the synergy between Blibli, tiket.com and Ranch Market within an integrated ecosystem in providing seamless shopping experience and value-added for customers through a more complete, wholesome, and integrated offering in every customer’s touch point.

In 2022, the Company’s shares were officially listed and traded on the Indonesia Stock Exchange (“IDX”) with the ticker code “BELI”.