30th March 2023 | Jakarta, Indonesia

PT Global Digital Niaga Tbk (the “Company”; IDX: BELI), a pioneer omnichannel commerce and lifestyle ecosystem in Indonesia focusing on serving digitally connected retail and institutions consumers, today announced its full year earnings results for the year 2022.

KEY HIGHLIGHTS

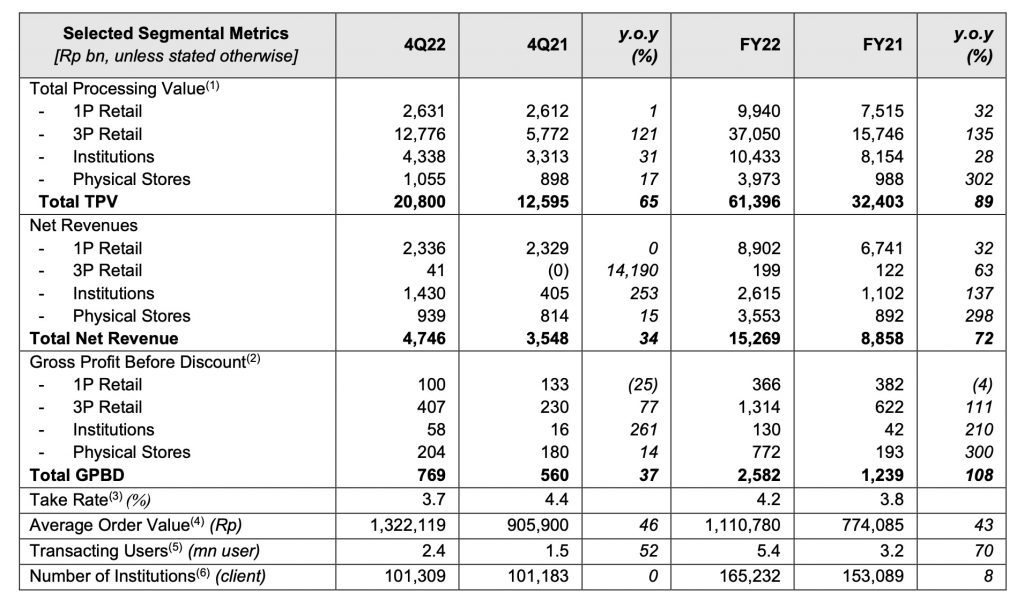

- The Company recorded strong TPV growth of 65% from Rp12,595 bn in 4Q21 to Rp20,800 bn in 4Q22, and by 89% from Rp32,403 bn in FY21 to Rp61,396 bn in FY22, driven by increased performance in all business segments.

- Strong recovery of online travel business post the re-opening of pandemic restrictions in Indonesia positively impacted our 3P Retail TPV, which grew by 121% y.o.y in 4Q22 and 135% y.o.y in FY22.

- Consolidated net revenues also grew by 34% from Rp3,548 bn in 4Q21 to Rp4,746 bn in 4Q22, and by 72% from Rp8,858 bn in FY21 to Rp15,269 bn in FY22.

- Consolidated gross margin recorded at 6.5% in FY21 and 8.0% in FY22, improved by 150-bps y.o.y mainly due to higher take rate.

- Managed better cost structure resulting in the improvement of consolidated EBITDA as percentage to TPV from -9.0% in 4Q21 to -6.4% in 4Q22, and from -10.4% in FY21 to -7.8% in FY22, each improved by 260 bps y.o.y, respectively.

- Appointed as one of the key strategic partners in Indonesia for global leading brand – Apple, which complements the long-lasting relationships that have been established with some of other global leading brands, including Samsung. This will be positive growth driver for our 1P Retail business going forward.

- Amplified omnichannel strategy through the expansion of physical stores in both consumer electronics and supermarket chain. The Company opened a total of 74 new consumer electronics physical stores during the year, bringing to a total of 126 consumer electronics physical stores operated by the Company at the end of 2022.

- Completion of Initial Public Offering of the Company’s shares on Indonesia Stock Exchange, raising gross proceeds of approximately ~Rp8 trillion.

MANAGEMENT STATEMENT(S)

Kusumo Martanto – CEO & Co-Founder

“Certainly, 2022 was full of challenges along with many uncontrollable factors. The big theme for technology players in Indonesia nowadays, especially for e-commerce, is how to adapt with the dynamic changes of consumer preferences to do transactions post the re-opening of pandemic restrictions. However, we stayed true to our path and strategies throughout the year, including carried out new initiatives in our e-commerce and OTA platforms, deepened the synergies within our ecosystem, and accelerated the expansion of offline presence to boost our omnichannel strategy.

Since the beginning, we always emphasize and put our efforts in the true manners to build the right business model that focuses on providing the best experiences and services to customers, developing beneficial long- term relationships with all partners as well as developing ecosystem play systematically, which all enable ourselves to grow sustainably. With the changing market landscape, we believe that we are now in a better position to compete and more confident than ever to grow and reach profitability.”

Hendry – CFO & Co-Founder

“Throughout 2022, we have seen our businesses grew quite rapidly in all business segments above the industry trends, along with healthier financial performances. This was a result of our continuous efforts in several strategic steps including expansion of product assortments, growing our ecosystem and implementing cost efficiencies in many areas to achieve better cost structure. Meanwhile, our cash position along with the credit facilities that we have is sufficient for us to carry out all our business strategies going forward. In 2023, we highly believe that with focuses on cost leadership, margin optimization and ecosystem operational excellence, we are on the right track to grow the business even further, and at the same time, getting us even closer to profitability.

KEY OPERATIONAL HIGHLIGHTS

Source: Company’s Information

(1) Total Processing Value (“TPV”) is total value of paid and delivered purchases for products and services in the relevant year/period

(2) Gross Profit Before Discount (“GPBD”) is gross profit earned from direct sales after adding back discount and subsidies during the relevant year/period

(3) Take Rate is defined as GPBD divided by TPV in the relevant year/period

(4) Average Order Value (“AOV”) is TPV on Blibli and tiket.com platforms divided by the total number of orders for paid purchases facilitated by these platforms, each for the relevant year/period

(5) Transacting Users (“YTU”) is the number of unique users that have completed at least one paid transaction on Blibli and/or tiket.com platforms during the relevant year/period

(6) Institution Clients includes both from public and private sectors

BUSINESS OVERVIEW

Below is an overview from each business segment of the Company during the fourth quarter of 2022 (4Q22) compared to the fourth quarter of 2021 (4Q21) period and full year 2022 (FY22) compared to full year 2021 (FY21):

1P Retail

1P Retail segment undertakes the Company’s business through its B2C platform for first-party (1P) products and services on its e-commerce platform.

Overall TPV for this segment grew by 32% from Rp7,515 bn in FY21 to Rp9,940 bn in FY22, mainly driven by strong growth demand in the consumer electronics, consumer goods and digital products & others categories. This resulted in an increase of net revenues for this segment by 32% from Rp6,741 bn in FY21 to Rp8,902 bn in FY22. However, GPBD decreased by 4% in FY22 y.o.y, mainly due to the changes in the product category mix.

In the third quarter 2022, the Company was appointed as one of the strategic partners in Indonesia for global leading brand – Apple, which includes the licenses for importation, distribution, and authorized reseller for retail, education and institutional both online and offline. This appointment is expected to boost the performance for this segment going forward.

3P Retail

3P Retail segment predominantly records the Company’s platform fees generated from sales of products and services from third-party (3P) sellers through its e-commerce and online travel agent (OTA) platforms.

Overall TPV for this segment grew by 135% from Rp15,746 bn in FY21 to Rp37,050 bn in FY22, mainly contributed by the much-improved performance in the lifestyle category on the back of strong online travel recovery as a result of the re-opening of pandemic restrictions in Indonesia starting second quarter 2022. This resulted in an increase of net revenues for this segment by 63% from Rp122 bn in FY21 to Rp199 bn in FY22. GPBD also increased by 77% and 111% in 4Q22 and FY22 y.o.y respectively, following the Company’s strong growth in online travel capitalizing on pandemic recovery trend in fourth quarter 2022.

As at the end of 2022, the Company’s OTA platform had a vast product assortment offering, including 101 airline partners covering more than 220 countries, regions and territories, more than 3.6 million accommodation listings, including 2.2 million alternative accommodations, more than 49,000 activities and attractions as well as more than 2,300 events across Indonesia.

Institutions

Institution segment includes the Company’s business through its B2B platform for 1P and 3P products and services for private and public-sector institutions across Indonesia.

Overall TPV for this segment grew by 28% from Rp8,154 in FY21 to Rp10,433 bn in FY22, mainly contributed by the increased number of institution clients from 153k clients in FY21 to 165k clients in FY22. This resulted in a significant increase of net revenues for this segment by 137% from Rp1,102 bn in FY21 to Rp2,615 bn in FY22. GPBD also increased by 261% and 210% in 4Q22 and FY22 y.o.y respectively, supported by the increase of total spending per institution client from Rp32.7 mn in 4Q21 to Rp42.8 mn in 4Q22, and from Rp53.3 mn in FY21 to Rp63.1 mn in FY22.

In 2022, the Company was appointed as one of the key suppliers for the national procurement on the E- Catalog platform, an online shopping application developed by the Government Goods-Services Procurement Policy Agency (Lembaga Kebijakan Pengadaan Barang-Jasa Pemerintah/LKPP).

Physical Stores

Physical Stores segment records the Company’s business in consumer electronics physical stores partnering with global leading brands and premium grocery supermarkets chain operated by 70.56%-owned subsidiary, PT Supra Boga Lestari Tbk (“Ranch Market”; IDX: RANC).

Overall TPV for this segment grew by 302% from Rp988 bn in FY21 to Rp3,973 bn FY22, mainly driven by the full consolidation of Ranch Market in 2022, which was only acquired by the Company at the end of September 2021. This resulted in an increase of net revenues for this segment by 298% from Rp892 bn in FY21 to Rp3,553 bn FY22. GPBD also increased by 14% and 300% in 4Q22 and FY22 y.o.y respectively, as some of the Company’s new consumer electronics physical stores and supermarket outlets were starting to ramp up during the year.

As at the end of 2022, the Company operates a total of 126 consumer electronics physical stores, which consists of 79 monobrand stores, such as Samsung Experience Store and hello (Apple monobrand store), 47 multibrand stores, such as Blibli Store and Tukar Tambah (trade-in store), as well as 70 premium supermarket outlets nationwide.

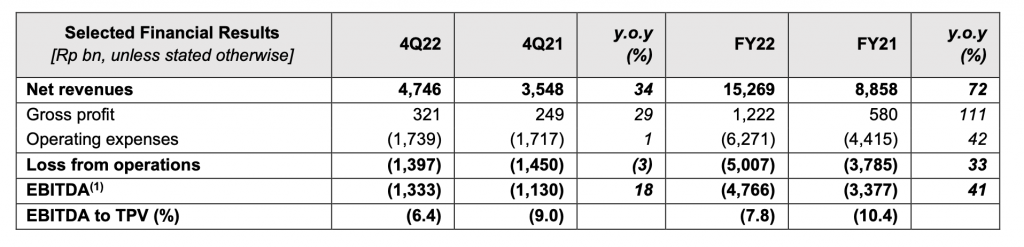

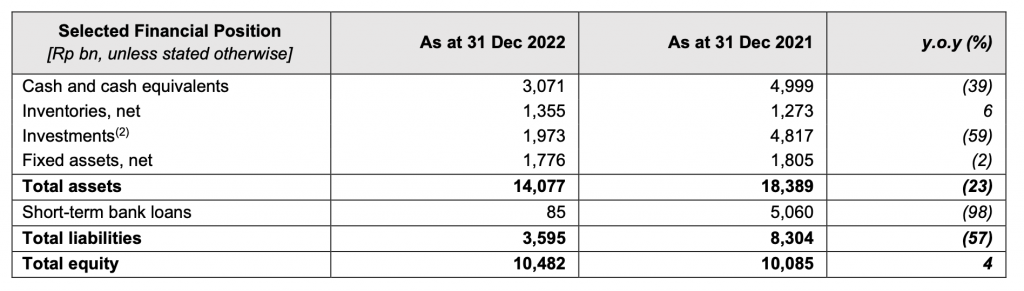

CONSOLIDATED FINANCIAL PERFORMANCES

The financial results for year ended 31st December 2022 and 2021 as well as the financial position as at 31st December 2022 and 2021 have been prepared in accordance with Indonesian Financial Accounting Standards and audited in accordance with the auditing standards established by the Indonesian Institute of Certified Public Accountants.

(1) EBITDA refers to Earnings Before Interest, Tax, Depreciation and Amortization (“EBITDA”): earnings before interest, tax, depreciation of fixed assets and amortization of intangible assets, and excludes non-recurring items, during the relevant year/period

(2) Investments refers to the Company’s investments balance in the form of shares, fund, convertible loan, and associate entities

MANAGEMENT DISCUSSION & ANALYSIS

Below are brief descriptions of the Company’s consolidated financial performances during the fourth quarter 2022 (4Q22) compared to fourth quarter 2021 (4Q21) period and full year 2022 (FY22) compared to full year 2021 (FY21):

Revenue & Profitability

Consolidated net revenues recorded 34% increase from Rp3,548 bn in 4Q21 to Rp4,746 bn in 4Q22 mainly driven by growth in Institutions segment, which experienced improvement in total spending per institution clients, and 72% increase from Rp8,858 bn in FY21 to Rp15,269 bn in FY22 mainly contributed from increased TPV in all segments, including the strong growth demand in certain products categories of 1P Retail segment, much better performances of lifestyle category of 3P Retail segment on the back of online travel industry recovery, as well as the full consolidation of Ranch Market in 2022.

The TPV and net revenues growth was supported by organic growth, as shown by the increase of transacting users from 3.2 million users in FY21 to 5.4 million users in FY22, and higher average order value by 46% in 4Q22 and 43% in FY22 y.o.y, respectively, as well as improved quality of users shown by increased spending per user from Rp7.3 mn in FY21 to Rp8.7 mn in FY22. Further, the Company successfully improved its take rate from 3.8% in FY21 to 4.2% in FY22. Hence, the Company recorded a better consolidated gross margin from 6.5% in FY21 to 8.0% in FY22, despite changes in product mix during fourth quarter 2022.

The Company also successfully improved its operational performances on the back of better cost structure, shown from lower advertising & marketing expenses as percentage to TPV from 3.6% in 4Q21 to 2.0% in 4Q22, and from 3.6% in FY21 to 2.8% in FY22, as well as lower general & administrative expenses as percentage to TPV from 8.1% in 4Q21 to 4.7% in 4Q22, and from 7.8% in FY21 to 5.5% in FY22. This resulted in an improved consolidated EBITDA performance as percentage to TPV from -9.0% in 4Q21 to -6.4% in 4Q22, and from -10.4% in FY21 to -7.8% in FY22.

Liquidity & Cash Position

Net cash used in operating activities was Rp4,974 bn in FY22, primarily represents cash payment to suppliers of Rp35,227 bn and cash payment for operational expenses of Rp3,871 bn, partly offset by cash receipts from customers amounted Rp36,092 bn. Net cash provided from investing activities was Rp502 bn in FY22, mainly represents cash proceeds from net sale of investments of Rp777 bn, partly offset by the acquisition of fixed assets of Rp195 bn during the year. Net cash provided from financing activities was Rp2,545 bn in FY22, primarily represents cash receipts from initial public offering of Rp7,740 bn and cash receipts from short-term bank loans of Rp6,139 bn, partly offset by cash payment of short-term bank loans of Rp11,115 bn. Therefore, the Company’s cash and cash equivalents position as at 31st December 2022 was at Rp3,071 bn compared to Rp4,999 bn as at 31st December 2021.

CORPORATE ACTION(S)

In November 2022, the Company had completed an Initial Public Offering (“IPO”) in Indonesia Stock Exchange (“IDX”) with ticker code “BELI”, offering 100% primary shares to the domestic investor and international qualified institutional buyer with Reg S / 144A distribution. The IPO was successfully priced near the top end of the price range at Rp450 per share. The offer shares in this IPO were maximized to 15.00% of enlarged share capital, raising gross proceeds of ~Rp8 trillion (equivalent to US$513 mn1). With a total market capitalization of Rp53.3 tn (equivalent to US$3.4 bn1), the Company’s IPO was the second-largest IPO in Indonesia in 2022.

BUSINESS PROSPECTS

In 2023, the Company will focus on further developing and strengthening the potential synergies within the ecosystem to enhance more cross-selling between platforms, as well as amplifying its omnichannel strategy through further expansion of physical stores. This will allow the Company to grow more efficiently by reducing the advertising and marketing expenses and hence lowering the customer acquisition costs. With cost leadership, margin optimization and ecosystem operational excellence as the main focuses in 2023, the Company believes that it can grow the business even further and, at the same time, paving the right path for profitability.

– End –

Disclaimer

This document (“Publication”) has been prepared by PT Global Digital Niaga Tbk. (the “Company”) for information purposes only and does not constitute a recommendation or an offer to buy regarding any securities of the Company. The information contained in this Publication has not been independently verified, approved, and/or endorsed and is subject to material changes. The information and opinions in this Publication are of a preliminary nature, subject to change without notice, its accuracy is not guaranteed, and it may not contain all material information concerning the Company. None of the Company, its management, its advisors nor any of their respective affiliates, shareholders, directors, employees, agents, and/or advisers (together, “the Group”) assumes any responsibility or liability whatsoever (in negligence or otherwise) for, the accuracy or completeness of, or any errors or omissions in, any information contained herein nor for any loss howsoever arising from any use of information within.

The information contained in this Publication should be considered in the context of the circumstances prevailing at the time published and is subject to change without notice and/or will not be updated to reflect material developments that may occur after the date hereof. The statements contained in this Publication speak only as at the date as of which they are made, and the Company expressly disclaims any obligation or undertaking to supplement, amend or disseminate any updates or revisions to any statements contained herein to reflect any change in events, conditions and/or circumstances on which any such statements are based. This Publication may not be all-inclusive and may not contain all the information that a recipient or reader may consider material. By preparing this Publication, the Group does not undertake any obligation to provide any recipient or readers with access to any additional information or to update this Publication or any additional information or to correct any inaccuracies in any such information which may become apparent. The Group shall not make any express or implied representation and/or warranty as to the accuracy and completeness of the information contained herein and none of them shall accept any responsibility or liability (including any third-party liability) for any loss or damage, whether arising from any error or omission in compiling such information or as a result of any party’s reliance or use of such information.

Forward-looking Statement

Certain statements in this Publication constitute “forward-looking statements” and information with respect to the future financial condition, results of operations and certain plans and/or objects of management of the Company and the Group. Forward-looking statements may include words or phrases such as the Company or any of its business components, or its management “believes”, “expects”, “anticipates”, “intends”, “plans”, “foresees”, or other words or phrases of similar import. Similarly, statements that describe the Company’s objectives, plans or goals both for itself and for any of its business components also are forward-looking statements. Such forward-looking statements are made based on management’s current expectations or beliefs as well as assumptions made by, and information currently available to, management. A such forward-looking statement is not a guarantee of future performance and involves known and unknown risks, uncertainties, and other factors (including the risks and uncertainties in the Company’s financial statements and Management Discussion & Analysis available on the Company’s website), that may cause actual results, performance, or achievements to be materially different from the future results, performance or achievements expressed or implied by such forward-looking statement. The Company disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, events or otherwise. Readers are cautioned not to put undue reliance on such a forward-looking statement.

Non-IFAS Financial Measures

To supplement the Company’s consolidated financial statements, which are prepared and presented in accordance with statement of financial accounting standards in Indonesia (“IFAS”), the Company provides certain non-IFAS financial measures, including but not limited to, “EBITDA”, “GPBD” and/or “Take Rate”, which should be considered in addition to results prepared in accordance with IFAS but not in isolation or as substitutes for IFAS results. Such non-IFAS financial measures may differ from similarly titled measures used by other companies and are presented to enhance recipients or readers the overall understanding of the Company’s financial performances and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with IFAS. In

addition, this Publication contains certain operating metrics including, but not limited to, “TPV”, “YTU”, “AOV” and/or “MAU”, used by the Company to evaluate its business. Such operating metrics may differ from estimates published by third parties or from similarly titled metrics used by other companies due to differences in methodology and assumptions.

About the Company

Established in 2010, PT Global Digital Niaga Tbk (the “Company”) is a pioneer omnichannel commerce and lifestyle ecosystem in Indonesia, focusing on serving digitally connected retail and institutions consumers. The Company’s commerce platform – Blibli, integrates online consumer shopping experience through its e-commerce platform and offline shopping experience through operating physical stores for some leading global brand partners. In addition, Blibli also collaborating with more than 29,000 stores adopting omnichannel features, namely Blibli Instore and Click & Collect, supported by its own fulfillment infrastructure, including developed nationwide warehouses and logistics networks as well as enhance the first-party (1PL) last-mile delivery capabilities through BES Paket and cooperating with numerous third-party (3PL) logistics partners. Blibli is ranked no.1 in the B2C omnichannel 1P consumer electronics and fresh products categories by Frost & Sullivan and has award-winning 24/7 customer service.

In 2017, the Company acquired PT Global Tiket Network (tiket.com) to expand its offerings to include traveling, accommodations, and lifestyle experiences. Further in 2021, the Company’s omnichannel ecosystem was complemented by adding fresh foods and groceries offering through the acquisition of PT Supra Boga Lestari Tbk (“Ranch Market”; IDX: RANC) – a company that manages premium supermarkets outlets such as Ranch Market and Farmers Market.

The Company has a unified omnichannel ecosystem called Blibli Tiket, to strengthen the synergy between Blibli, tiket.com and Ranch Market within an integrated ecosystem in providing seamless shopping experience and value-added for customers through a more complete, wholesome, and integrated offering in every customer’s touch point.

In 2022, the Company’s shares were officially listed and traded on the Indonesia Stock Exchange (“IDX”) with the ticker code “BELI”.