30th November 2023 | Jakarta, Indonesia

PT Global Digital Niaga Tbk (the “Company”; IDX: BELI), a pioneer and leading omnichannel commerce and lifestyle ecosystem in Indonesia focusing on serving digitally connected retail and institutions consumers, today announced its third quarter earnings results for the year 2023.

KEY HIGHLIGHTS

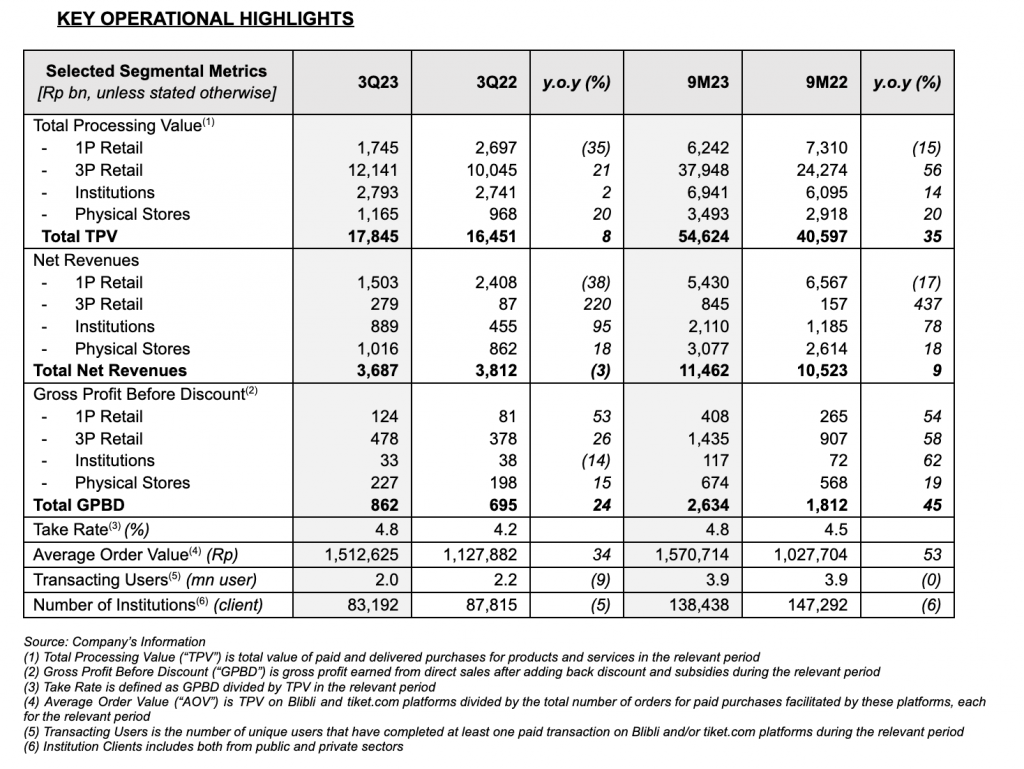

- TPV grew by 8% in 3Q23 y.o.y to Rp17,845 bn, and by 35% in 9M23 y.o.y to Rp54,624 bn, mainly driven by the increased performance in 3P Retail and Institutions segments.

- This resulted in an increase of consolidated net revenues by 9% in 9M23 y.o.y to Rp11,462 bn, despite a slight decrease of 3% in 3Q23 y.o.y due to the Company’s decision to continue optimizing its TPV mix by rationalizing some of the products across categories in 1P Retail segment. Since September 2023, the Company has started to implement platform fee to all online retail orders in its e-commerce platform, which provides additional revenue for the Company.

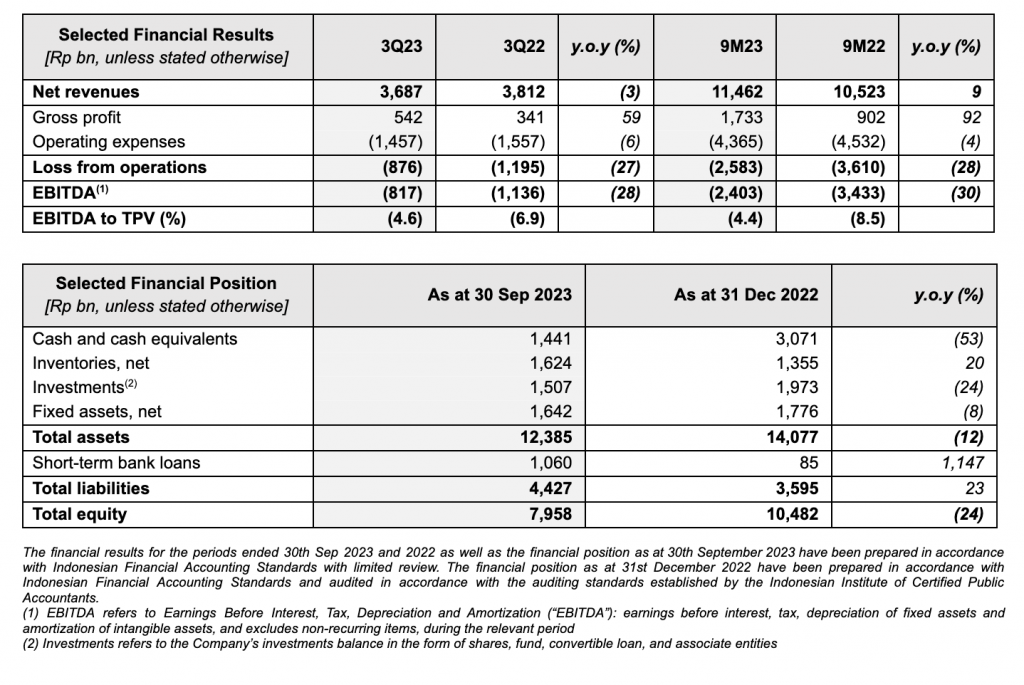

- The Company successfully recorded a higher consolidated gross margin of 14.7% in 3Q23 and 15.1% in 9M23, an improvement of 580-bps and 660-bps y.o.y, respectively.

- Cost structure kept improving, reflected by the lower consolidated operating expenses as percentage to TPV from 9.5% in 3Q22 to 8.2% in 3Q23, and from 11.2% in 9M22 to 8.0% in 9M23. This resulted in the improvement of consolidated EBITDA as percentage to TPV by 230-bps and 410-bps y.o.y in 3Q23 and 9M23 period to -4.6% and -4.4%, respectively.

- Continued amplifying omnichannel strategy with an additional of 29 consumer electronic stores during the nine-month of 2023 period, which brings a total of 155 consumer electronics stores operated by the Company, as well as 67 premium supermarkets outlets at the end of September 2023.

- As at the end of September 2023, the construction progress of the new Marunda warehouse has reached ~30% and is projected to start operating in stages by 2024.

- The Company’s unified loyalty program – blibli tiket rewards, which was launched in March 2023, has been extended to Ranch Markets’ customers as well as integrated to the Company’s physical consumer electronics’ stores nationwide, enabling all customers within Blibli Tiket ecosystem to enjoy a more seamless customer experience both online and offline.

MANAGEMENT STATEMENT(S)

Kusumo Martanto – CEO & Co-Founder

“As a leading omnichannel commerce and lifestyle platform, we always seek ways to adapt, innovate and transform for the better in the evolving market dynamics and digital landscape era. This is done by promoting technological innovations in all aspects of our business (customer facing and our operational process), to serve and fulfill our stakeholders’ needs, including our customers, partners, employees, and shareholders.

We have taken a holistic approach to meet our diverse customers’ needs. One of the crucial steps is to continue expanding our offline stores presence in many cities, through adding more consumer electronics stores for the past nine months, which will further enrich our customers’ journey and seamless shopping experience within our integrated omnichannel ecosystem.

On the logistic aspect, we have also strengthened our backbone services through the Fulfillment at Speed (FAS) service, a technology-driven approach covering every aspect of e-commerce fulfillment, including centralized operations and storages, as well as an AI based approach to reduce our overall cost and time spent on fulfillment process in our warehouses; thus speeding-up the delivery time to our customers. In addition, our refreshed branding with the new Logo reflects a visual testament to our ongoing commitment to simplify, facilitate, and elevate our user experiences.

As we draw closer to the close of 2023, it’s encouraging to observe notable advancements across the various segments of our Company. There’s been a material enhancement of our operational margins, a testament to the effectiveness of our strategic initiatives.

Key among these has been the development of a more cohesive and integrated omnichannel shopping experience, which we have developed in-house. This effort has been bolstered significantly by the expertise of our award-winning customer care team. Additionally, our commitment to innovation, particularly in harnessing the potential of artificial intelligence and machine learning, has yielded substantial improvements in cost efficiency. This, in turn, has been instrumental in fostering sustainable growth.

We are confident that the cumulative effect of these improvements, diligently implemented throughout the year, positions us well on the path towards profitability. It’s a path that reflects not only our current achievements but also our enduring commitment to long-term value creation for our shareholders.”

Ronald Winardi – CFO

“We continued our efforts on the rationalization of our product mix across 1P Retail segment while maintaining our focus more on certain more profitable products categories throughout the third quarter of 2023, which has resulted in better gross profit generation and healthier gross margin. Our relentless efforts on cost efficiencies have also exhibited positive impacts on our consolidated financial results.”

KEY OPERATIONAL HIGHLIGHTS

BUSINESS OVERVIEW

Below is an overview from each of the Company’s business segment during the third quarter of 2023 (3Q23) compared to the third quarter of 2022 (3Q22) period, and the first nine months of 2023 (9M23) compared to the first nine months of 2022 (9M22) period.

1P Retail

1P Retail segment undertakes the Company’s business through its B2C online commerce platform for first-party (1P) products and services from various categories.

GPBD improved strongly by 53% in 3Q23 y.o.y to Rp124 bn and by 54% in 9M23 y.o.y to Rp408 bn, reflecting higher margin as a result of the Company’s decision to continue optimizing its TPV mix by rationalizing some of the products across categories, especially on the consumer electronics and consumer goods, and focusing more on certain more profitable products in this segment. The rationalization measure taken led to lower net revenues for this segment by 17% in 9M23 y.o.y to Rp5,430 bn. Meanwhile, overall TPV also declined by 15% from Rp7,310 bn in 9M22 to Rp6,242 bn in 9M23. However, the Company expects this strategy will further improve the gross margin for this segment going forward.

In May 2023, the Company executed the groundbreaking of the new 100,000 sqm-warehouse in Marunda, West Java, an all-in-one-tech-powered warehouse by Blibli to support the Company’s commitment in pioneering smart logistics and supply chain management. As at the end of September 2023, the construction progress has reached ~30%, and is projected to start operating in stages by 2024. This Marunda warehouse will be the Company’s largest warehouse and will complement Blibli’s existing ~130,000 sqm area of the current 16 warehouses.

3P Retail

3P Retail segment predominantly records the Company’s platform fees generated from sales of products and services of various categories from third-party (3P) sellers through its online commerce and online travel agent (OTA) platforms.

Overall TPV for this segment grew healthily by 21% from Rp10,045 bn in 3Q22 to Rp12,141 bn in 3Q23, and by 56% from Rp24,274 bn in 9M22 to Rp37,948 bn in 9M23, predominantly driven by strong performances of the Company’s OTA business and stronger contribution from the digital products & others category. This resulted in a significant increase in net revenues for this segment by 220% in 3Q23 y.o.y to Rp279 bn, and by 437% in 9M23 y.o.y to Rp845 bn. GPBD also grew by 26% in 3Q23 y.o.y to Rp478 bn, and by 58% in 9M23 y.o.y to Rp1,435 bn, supported by increased contributions from higher margin products category in the Company’s OTA business.

In March 2023, the Company launched “blibli tiket rewards” as the first omnichannel integrated and unified loyalty program in the commerce and lifestyle ecosystem in Indonesia for the Blibli and tiket.com users, which subsequently was also extended to be available for Ranch Market’ customers in June 2023. Further in October 2023, blibli tiket rewards has also been integrated to all of the Company’s physical consumer electronics’ stores nationwide, enabling all customers within the Blibli Tiket ecosystem to enjoy a more seamless customer experience both online and offline.

As at the end of September 2023, the Company’s OTA platform – tiket.com, had a vast product assortment offering, including 112 airline partners covering 225 countries, regions, and territories, more than 3.6 million accommodation listings, including 2.2 million alternative accommodations, more than 69,400 activities and attractions as well as more than 3,300 events across Indonesia.

Institutions

Institutions segment includes the Company’s business through its B2B and B2G platforms for 1P and 3P products and services serving private and public-sector institutions across Indonesia.

Overall TPV for this segment grew by 2% from Rp2,741 bn in 3Q22 to Rp2,793 bn in 3Q23, and by 14% from Rp6,095 bn in 9M22 to Rp6,941 bn in 9M23. The increase was mainly contributed by the Company’s distribution business where we saw higher spending per institutional clients from Rp31.2 mn per client in 3Q22 to Rp33.6 mn per client in 3Q23, and from Rp41.4 mn per client in 9M22 to Rp50.1 mn per client in 9M23. This resulted in an increase of net revenues for this segment by 95% in 3Q23 y.o.y to Rp889 bn, and by 78% in 9M23 y.o.y to Rp2,110 bn. GPBD for this segment also grew healthily by 62% in 9M23 y.o.y to Rp117 bn.

The monetization rate for this segment also improved, reflected by higher net revenues as percentage to TPV from 17% in 3Q22 to 32% in 3Q23, and from 19% in 9M22 to 30% in 9M23, reflecting higher trusts from the institution clients towards the Company’s platform to fulfil their corporation needs.

Physical Stores

Physical Stores segment records the Company’s business in consumer electronics stores collaborating with global leading brands partners, as well as premium grocery supermarkets chain operated by 70.6%-owned Subsidiary, PT Supra Boga Lestari Tbk (“Ranch Market”; IDX: RANC).

Overall TPV for this segment grew by 20% in both 3Q23 and 9M23 y.o.y to Rp1,165 bn and Rp3,493 bn, respectively, mainly driven by the improved performances of the Company’s consumer electronics stores, especially with the additional opening of new “hello” stores (the Company’s monobrand stores for Apple) during the period. This resulted in an increase in net revenues for this segment by 18% in both 3Q23 and 9M23 y.o.y to Rp1,016 bn and Rp3,077 bn, respectively. Meanwhile, GPBD in this segment also grew by 15% in 3Q23 y.o.y to Rp227 bn, and by 19% in 9M23 y.o.y to Rp674 bn.

Throughout the nine-month of 2023 period, there were a total of 29 additional consumer electronics stores to boost the Company’s omnichannel strategy. As at the end of September 2023, the Company operated a total of 155 consumer electronics stores, which consists of 81 monobrand stores (including 66 Samsung Stores and 7 hello stores, along with the other global leading brand stores), and 74 multibrand stores (including 21 Blibli Stores and 53 Tukar Tambah stores), as well as 67 premium supermarket outlets nationwide operated by Ranch Market.

CONSOLIDATED FINANCIAL PERFORMANCES

The financial results for the periods ended 30th Sep 2023 and 2022 as well as the financial position as at 30th September 2023 have been prepared in accordance with Indonesian Financial Accounting Standards with limited review. The financial position as at 31st December 2022 have been prepared in accordance with Indonesian Financial Accounting Standards and audited in accordance with the auditing standards established by the Indonesian Institute of Certified Public Accountants.

(1) EBITDA refers to Earnings Before Interest, Tax, Depreciation and Amortization (“EBITDA”): earnings before interest, tax, depreciation of fixed assets and amortization of intangible assets, and excludes non-recurring items, during the relevant period

(2) Investments refers to the Company’s investments balance in the form of shares, fund, convertible loan, and associate entities

MANAGEMENT DISCUSSION & ANALYSIS

Below are brief descriptions of the Company’s consolidated financial performances during the third quarter of 2023 (3Q23) compared to the third quarter of 2022 (3Q22) period, and the first nine months of 2023 (9M23) compared to the first nine months of 2022 (9M22) period.

Revenue & Profitability

Consolidated net revenues recorded 9% increase from Rp10,523 bn in 9M22 to Rp11,462 bn in 9M23, mainly contributed by the increased performance in 3P Retail segment, driven by strong performance of the Company’s online travel agent (OTA) business and stronger contribution from the digital products & others category, as well as increased performance in the Institutions segment, which was contributed from the Company’s distribution business for Apple and increased spending quality of institution clients during the period. Since September 2023, the Company has also started to implement platform fee to all online retail orders in its e-commerce platform, which provides additional revenue for the Company, without any significant impact on overall check-out drop rate.

The increased in TPV and net revenues were also supported by organic growth, shown by higher average order value by 53% from Rp1,027,704 in 9M22 to Rp1,570,714 in 9M23, as well as improved quality of retail users shown by increased spending per user by 40% from Rp8.2 mn in 9M22 to Rp11.4 mn in 9M23.

The Company recorded a better consolidated gross margin in 3Q23 and 9M23 y.o.y to 14.7% and 15.1%, an improvement of 580-bps and 660-bps, respectively. The increase in gross margin was driven by gross profit expansion in both 1P Retail and 3P Retail segments, and optimization of discounting by leveraging the Company’s ecosystem strength and organic growth.

The Company also continued to improve its operational excellence which resulted in a better cost structure, reflected from lower consolidated operating expenses as percentage to TPV from from 11.2% in 9M22 to 8.0% in 9M23, mainly driven by the lower advertising & marketing expenses as percentage to TPV during the 9M23 y.o.y, from 3.1% to 1.3%. Meanwhile, general and administrative expenses as percentage to TPV during the 9M23 y.o.y also recorded lower from 5.9% to 5.0%. This was achieved as a result of the Company continuous channels optimizations within ecosystem to grow the TPV at a lower marketing cost, and realignment of some of the human resources to improve productivity. This resulted in the improvement of consolidated EBITDA as percentage to TPV by 230-bps and 410-bps y.o.y in both 3Q23 and 9M23 to -4.6% and -4.4%, respectively.

Liquidity & Cash Position

Net cash used in operating activities was Rp2,903 bn in 9M23, primarily represents cash payment to suppliers of Rp29,543 bn and cash payment for operating expenses of Rp2,562 bn, partly offset by cash receipts from customers amounted Rp30,729 bn. Net cash provided by investing activities was Rp494 bn in 9M23, mainly contributed from the Rp538 bn of cash receipt from Halodoc divestment in June 2023. Net cash provided by financing activities was Rp778 bn in 9M23, primarily represents receipts of short-term bank loans of Rp4,887 bn, partly offset by cash payment of short-term bank loans of Rp3,912 bn. Therefore, the Company’s cash and cash equivalents position as at 30th September 2023 was at Rp1,441 bn compared to Rp3,071 bn as at 31st December 2022.

BUSINESS PROSPECTS

The Company continues to focus on improvement in profitability. As reflected in 9M23 results, the overall margin is improving, reflecting better focuses on product selections and pricing strategy that the Company offered to its customers, while cost efficiency measures were being implemented appropriately without sacrificing business growth potentials. The Company is ready to roll out more ecosystem synergies and innovations to drive more organic and more profitable growth.