28th July 2023 | Jakarta, Indonesia PT Global Digital Niaga Tbk (the “Company”; IDX: BELI), a pioneer and leading omnichannel commerce and lifestyle ecosystem in Indonesia focusing on serving digitally connected retail and institutions consumers, today announced its second quarter earnings results for the year 2023.

KEY HIGHLIGHTS

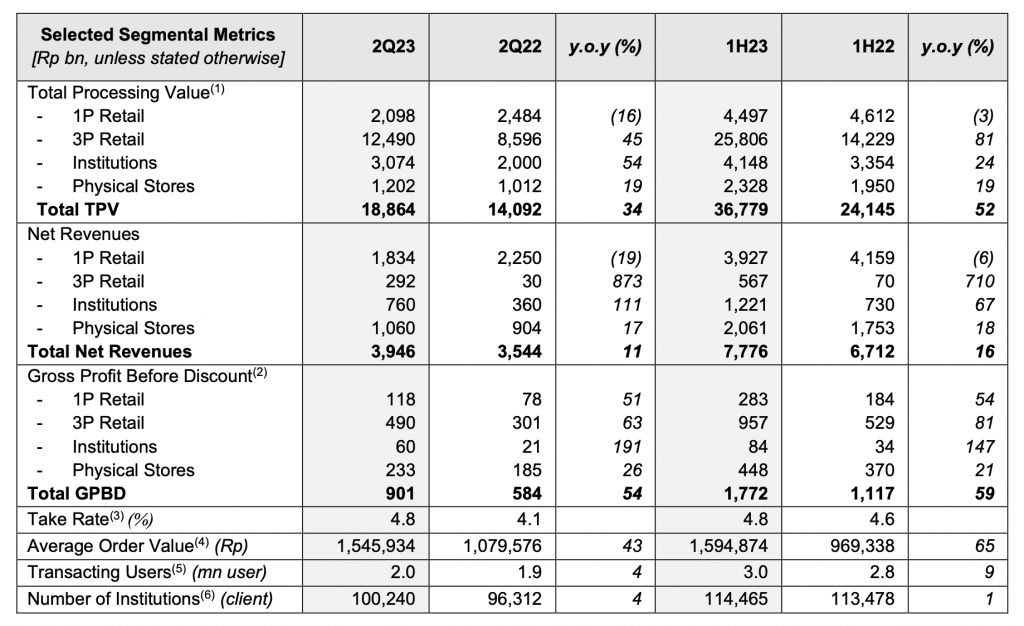

- Recorded TPV growth of 34% in 2Q23 y.o.y to Rp18,864 bn, and 52% in 1H23 y.o.y to Rp36,779 bn, mainly driven by the increased performance in 3P Retail and Institutions segments.

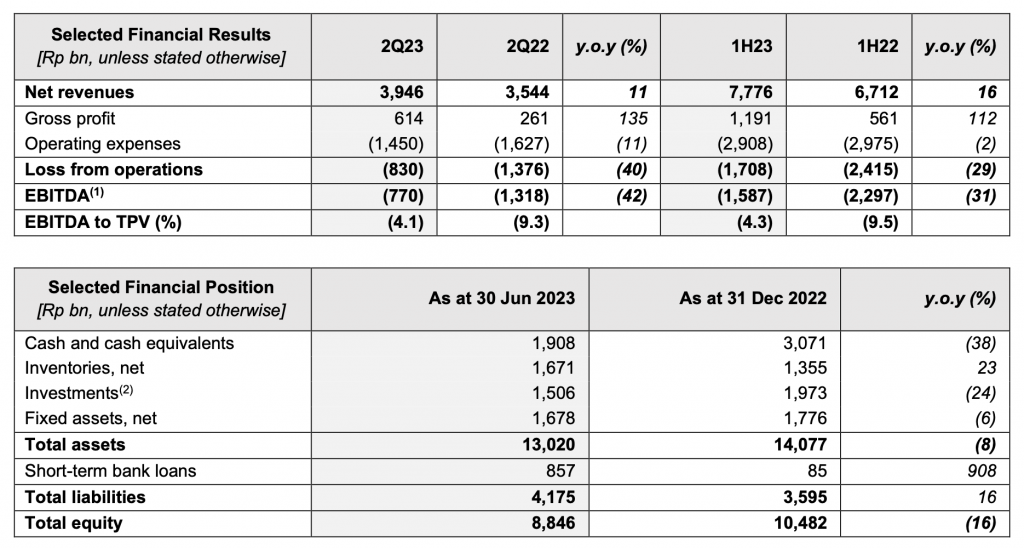

- Consolidated net revenues also grew by 11% in 2Q23 y.o.y to Rp3,946 bn, and by 16% in 1H23 y.o.y to Rp7,776 bn. This resulted in a significantly higher consolidated gross margin of 15.5% in 2Q23 and 15.3% in 1H23, an improvement of 810-bps and 690-bps y.o.y, respectively.

- Cost structure kept improving, reflected by the lower consolidated operating expenses as percentage to TPV from 11.5% in 2Q22 to 7.7% in 2Q23, and from 12.3% in 1H22 to 7.9% in 1H23. This resulted in the improvement of consolidated EBITDA as percentage to TPV by 520-bps y.o.y in both 2Q23 and 1H23 period to -4.1% and -4.3%, respectively.

- Continued amplifying omnichannel strategy with an additional of 14 consumer electronic stores during the period, which brings a total of 156 consumer electronics stores operated by the Company, as well as 70 premium supermarkets outlets.

- Executed the groundbreaking of the Company’s new warehouse in Marunda, West Java, an all-in- one tech-powered warehouse by Blibli to support the Company’s commitment in pioneering smart logistics and supply chain management.

- Launched “blibli tiket rewards” as the first omnichannel integrated and unified loyalty program in the commerce and lifestyle ecosystem, which enables the customers to enjoy more benefits in Blibli Tiket ecosystem.

- Completed the divestment of 7.23% stake in PT Polinasi Iddea Investama (“Halodoc”) to PT Global Investama Andalan (“GIA”) at a total transaction value of Rp538 bn. The divestment has been done to enable the Company to focus on core assets that are in line with its current business activities in order to accelerate the achievement of various targets set by the Company.

- Carried out Annual General Meeting of Shareholders (“AGMS”) and Extraordinary General Meeting of Shareholders (“EGMS”) in June 2023, where all of the agendas items proposed, including the appointment of a new member of Board of Directors and the establishment of the Company’s Management and Employee Stock Ownership Program (“MESOP”), were approved.

MANAGEMENT STATEMENT(S)

Kusumo Martanto – CEO & Co-Founder

“Our first half 2023 financial results were a positive trend which resulted in an improved profitability performance. However, we cannot be complacent and will not stop here; we’re going at full throttle to ensure that the Company will continue to implement its strategic plans into the right direction, including to drive focus on what our customers want, focus on the selections (categories) we plan to offer to them, and focus on the details that set us apart from the competition.

We also continue to strengthen our omnichannel presence, notably with the additional of 14 consumer electronics stores during the period. Meanwhile, to enhance operational excellence, we have also completed the groundbreaking of the new Marunda warehouse, an all-in-one-tech-powered warehouse by Blibli equipped with technology to support storage automation, supply chain distribution, all the way to delivery to end consumers directly. In addition, the launching of “blibli tiket rewards” as a unified loyalty program marked another milestone for the Company as the embodiment of convenience and more benefits for the customers to fulfill their various needs seamlessly within our integrated omnichannel commerce and lifestyle ecosystem.

Last but not least, please allow me to express my deepest gratitude for all our shareholders’ supports during the Company’s GMS in June, which resulted in approvals for all of the proposed agendas, showing how huge their supports are to the Board members to drive the Company’s future success.”

Ronald Winardi – CFO

“Throughout the second quarter of the year, we have been focusing on the alignment of our category mix across our 1P Retail & 3P Retail segment in order to accelerate the optimization of our gross profit generation. In combination with our relentless focus on cost discipline, we are pleased to see that our strategy has started to show positive results in our financial results. It is just the beginning, together, we shall continue to progress.”

KEY OPERATIONAL HIGHLIGHTS

Source: Company’s Information

(1) Total Processing Value (“TPV”) is total value of paid and delivered purchases for products and services in the relevant period

(2) Gross Profit Before Discount (“GPBD”) is gross profit earned from direct sales after adding back discount and subsidies during the relevant period

(3) Take Rate is defined as GPBD divided by TPV in the relevant period

(4) Average Order Value (“AOV”) is TPV on Blibli and tiket.com platforms divided by the total number of orders for paid purchases facilitated by these platforms, each for the relevant period

(5) Transacting Users is the number of unique users that have completed at least one paid transaction on Blibli and/or tiket.com platforms during the relevant period

(6) Institution Clients includes both from public and private sectors

BUSINESS OVERVIEW

Below is an overview from each of the Company’s business segment during the second quarter of 2023 (2Q23) compared to the second quarter of 2022 (2Q22) period, and the first half of 2023 (1H23) compared to the first half of 2022 (1H22) period.

1P Retail

1P Retail segment undertakes the Company’s business through its B2C online commerce platform for first- party (1P) products and services from various categories.

Overall TPV for this segment declined by 16% from Rp2,484 bn in 2Q22 to Rp2,098 bn in 2Q23, and by 3% from Rp4,612 bn in 1H22 to Rp4,497 bn in 1H23. The decline was mainly due to rationalization of some of the products across categories in order to improve gross margin for this segment. This resulted in a decrease in net revenues for this segment by 19% in 2Q23 y.o.y to Rp1,834 bn, and by 6% in 1H23 y.o.y to Rp3,927 bn. However, GPBD grew by 51% in 2Q23 y.o.y to Rp118 bn, and by 54% in 1H23 y.o.y to Rp283 bn, mainly driven from realignment to focus more on certain higher-margin products. The Company expects this strategy will further improve the gross margin for this segment going forward.

In May 2023, the Company executed the groundbreaking of the new 100,000 sqm-warehouse in Marunda, West Java, an all-in-one-tech-powered warehouse by Blibli to support the Company’s commitment in pioneering smart logistics and supply chain management. This new warehouse will implement green building concept and environmentally friendly design, as part of the Company’s commitment to create a sustainable business and a positive impact on the ESG aspects. The Marunda warehouse, which is projected to start operating in 2024, will be the Company’s largest warehouse and will complement the ~130,000 sqm area of the 16 warehouses currently-owned.

3P Retail

3P Retail segment predominantly records the Company’s platform fees generated from sales of products and services of various categories from third-party (3P) sellers through its online commerce and online travel agent (OTA) platforms.

Overall TPV for this segment grew healthily by 45% from Rp8,596 bn in 2Q22 to Rp12,490 bn in 2Q23, and by 81% from Rp14,229 bn in 1H22 to Rp25,806 bn in 1H23, predominantly driven by the much-improved performance in the lifestyle category on the back of online travel recovery as a result of the re-opening of pandemic restrictions in Indonesia, and higher contribution from the digital products & others category. This resulted in a significant increase in net revenues for this segment by 873% in 2Q23 y.o.y to Rp292 bn, and by 710% in 1H23 y.o.y to Rp567 bn. GPBD also grew by 63% in 2Q23 y.o.y to Rp490 bn, and by 81% in 1H23 y.o.y to Rp957 bn, in line with the better overall performance in this segment.

In March 2023, the Company launched “blibli tiket rewards” as the first omnichannel integrated and unified loyalty program in the commerce and lifestyle ecosystem for the Blibli and tiket.com users. Subsequently in June 2023, this loyalty program was further extended to be available for Ranch Market’s customers as well. Thus, the blibli tiket rewards is currently able to provide and offer more benefits for all customers within Blibli Tiket ecosystem.

As at the end of June 2023, the Company’s OTA platform – tiket.com, had a vast product assortment offering, including 107 airline partners covering more than 220 countries, regions, and territories, more than 3.6 million accommodation listings, including 2.2 million alternative accommodations, more than 64,800 activities and attractions as well as more than 2,900 events across Indonesia.

Institutions

Institutions segment includes the Company’s business through its B2B and B2G platforms for 1P and 3P products and services serving private and public-sector institutions across Indonesia. Overall TPV for this segment grew by 54% from Rp2,000 bn in 2Q22 to Rp3,074 bn in 2Q23, and by 24% from Rp3,354 bn in 1H22 to Rp4,148 bn in 1H23. The increased was mainly contributed by the increased number of institution clients from 96k clients in 2Q22 to 100k clients in 2Q23 period, and from 113k clients in 1H22 to 114k clients in 1H23 period. This resulted in an increase of net revenues for this segment by 111% in 2Q23 y.o.y to Rp760 bn, and by 67% in 1H23 y.o.y to Rp1,221 bn. GPBD also grew by 191% in 2Q23 y.o.y to Rp60 bn, and by 147% in 1H23 y.o.y to Rp84 bn, supported by the increased of total spending per institution client during the period. The monetization rate for this segment also improved, reflected by higher net revenues as percentage to TPV from 18% in 2Q22 to 25% in 2Q23, and from 22% in 1H22 to 29% in 1H23, reflecting higher trusts from the institution clients towards the Company’s platform to fulfil their corporation needs.

Physical Stores

Physical Stores segment records the Company’s business in consumer electronics stores collaborating with global leading brands partners, as well as premium grocery supermarkets chain operated by 70.56%-owned Subsidiary, PT Supra Boga Lestari Tbk (“Ranch Market”; IDX: RANC).

Overall TPV for this segment grew by 19% from Rp1,012 bn in 2Q22 to Rp1,202 bn 2Q23, and by 19% from Rp1,950 bn in 1H22 to Rp2,328 bn in 1H23, mainly driven by the improved performances of the Company’s consumer electronics stores, especially with the additional opening of new “hello” stores (the Company’s monobrand store for Apple) during the period. This resulted in an increase in net revenues for this segment by 17% in 2Q23 y.o.y to Rp1,060 bn, and by 18% in 1H23 y.o.y to Rp2,061 bn. Meanwhile, GPBD also grew by 26% in 2Q23 y.o.y to Rp233 bn, and by 21% in 1H23 y.o.y to Rp448 bn.

Throughout the second quarter of 2023, there were a total of 14 additional consumer electronics stores to boost the Company’s omnichannel strategy. As at the end of June 2023, the Company operated a total of 156 consumer electronics stores, which consists of 79 monobrand stores, such as Samsung Experience Store and hello, and 77 multibrand stores, such as Blibli Store and Tukar Tambah (trade-in store), as well as 70 premium supermarket outlets nationwide operated by Ranch Market.

CONSOLIDATED FINANCIAL PERFORMANCES

The financial results for the periods ended 30th June 2023 and 2022 as well as the financial position as at 30th June 2023 have been prepared in accordance with Indonesian Financial Accounting Standards and are unaudited. The financial position as at 31st December 2022 have been prepared in accordance with Indonesian Financial Accounting Standards and audited in accordance with the auditing standards established by the Indonesian Institute of Certified Public Accountants.

(1) EBITDA refers to Earnings Before Interest, Tax, Depreciation and Amortization (“EBITDA”): earnings before interest, tax, depreciation of fixed assets and amortization of intangible assets, and excludes non-recurring items, during the relevant period

(2) Investments refers to the Company’s investments balance in the form of shares, fund, convertible loan, and associate entities

MANAGEMENT DISCUSSION & ANALYSIS

Below are brief descriptions of the Company’s consolidated financial performances during the second quarter of 2023 (2Q23) compared to the second quarter of 2022 (2Q22) period, and the first half of 2023 (1H23) compared to the first half of 2022 (1H22) period.

Revenue & Profitability

Consolidated net revenues recorded 11% increase from Rp3,544 bn in 2Q22 to Rp3,946 bn in 2Q23, and by 16% from Rp6,712 bn in 1H22 to Rp7,776 bn in 1H23, mainly driven by the increased performance in 3P Retail segment, which benefited from much-improved performance in the lifestyle category on the back of online travel recovery in Indonesia and increased demand on the digital products & others category, as well as in the Institutions segment, which was contributed from higher number of institutional clients during the period.

The increased in TPV and net revenues were supported by organic growth, as shown by the increase of transacting users from 2.8 million users in 1H22 to 3.0 million users in 1H23, and higher average order value by 65% from Rp969,338 in 1H22 to Rp1,594,874 in 1H23, as well as improved quality of users shown by increased spending per user in retail business by 48% from Rp6.8 mn in 1H22 to Rp10.0 mn in 1H23. This resulted in a better consolidated gross margin for the Company to 15.5% in 2Q23 y.o.y and 15.3% in 1H23 y.o.y, an improvement of 810-bps and 690-bps, respectively.

The Company also kept improving its operational excellence which resulted in a better cost structure, reflected from lower consolidated operating expenses as percentage to TPV from 11.5% in 2Q22 to 7.7% in 2Q23, and from 12.3% in 1H22 to 7.9% in 1H23, mainly driven by the lower advertising & marketing expenses as percentage to TPV from 4.0% in 2Q22 to 1.0% in 2Q23, and from 3.6% in 1H22 to 1.2% in 1H23 as the Company continued to optimize channels within ecosystem to grow the TPV at a lower marketing costs. Meanwhile, general & administrative expenses as percentage to TPV also recorded lower from 5.6% in 2Q22 to 5.0% in 2Q23, and from 6.5% in 1H22 to 5.0% in 1H23. This resulted in the improvement of consolidated EBITDA as percentage to TPV by 520-bps y.o.y in both 2Q23 and 1H23 period to -4.1% and -4.3%, respectively.

Liquidity & Cash Position

Net cash used in operating activities was Rp2,324 bn in 1H23, primarily represents cash payment to suppliers of Rp20,055 bn, partly offset by cash receipts from customers amounted Rp20,547 bn. Net cash provided by investing activities was Rp525 bn in 1H23, mainly contributed from the Rp538 bn of cash receipt from Halodoc divestment. Net cash provided by financing activities was Rp636 bn in 1H23, primarily represents receipts of short-term bank loans of Rp2,897 bn, partly offset by cash payment of short-term bank loans of Rp2,125 bn. Therefore, the Company’s cash and cash equivalents position as at 30th June 2023 was at Rp1,908 bn compared to Rp3,071 bn as at 31st December 2022.

CORPORATE ACTION(S)

In June 2023, the Company had completed the sale of its 7.23% stakes in PT Polinasi Iddea Investama (“Halodoc”) to an affiliated party – PT Global Investama Andalan (“GIA”), at a total transaction value of Rp538 bn. The divestment was done to enable the Company to focus on core assets that are in line with its current business activities in order to accelerate the achievement of various targets set by the Company. Further, the consideration of the Company in conducting the divestment with affiliated party is to divert the investment risk in its portfolio by transferring the Company’s ownership in Halodoc to GIA, which is an affiliated party of the Company that has experience in investment activities. The transaction provided benefit to the Company, where the Company obtained some gain from this divestment and generated additional cash.

BUSINESS PROSPECTS

The Company believes the strategic business plans set out at the beginning of the year were right on target and in line with the Company’s efforts to achieve its goals for 2023, reflected by the continued positive performances trend during the second quarter of the year. The overall margin kept improving, reflecting better focuses on product selections and pricing strategy that the Company offered to its customers, while cost efficiency measures were being implemented appropriately without sacrificing business growth potentials. As the Company is ready to roll out more synergies and innovations to further complement the existing ecosystem operational excellence, the Company is convinced that it is on the right path to achieve profitability.